Lions,

LeoDex buybacks have officially started as of today. The affiliate address has several thousands of dollars already with more added to it every single day as LeoDex volume continue to grow.

Yesterday alone, over $1,000 was generated by LeoDex in revenue. 100% of this revenue buysback LEO off the open market.

ICYMI: LEO 2.0 launched on June 25th. This marked a major 180 in LEO tokenomics.

- LEO inflation set to 0

- All outstanding LEO burned (supply capped at 30M - can never increase)

- SIRP introduced (System Income Rewards Pool) - INLEO income buys LEO off the market and pays it to creators/curators instead of paying via inflation

- LeoDex affiliate revenue buysback LEO for 90 days until ~September 25th

- After Sept 25th, 100% of LeoDex affiliate revenue is paid to sLEO stakers on Arbitrum via LeoDex.io/leo

- ...

In this post, we'll focus on #4.

LeoDex POL Buybacks Have Begun!

POL stands for Protocol Owned LEO.

ICYMI: in the LEO 2.0 announcement, we launched a 90d buyback period for the LEO Token. Using 100% of LeoDex affiliate revenue, we are buying back the LEO token on the open market via the 4 pools on 4 blockchains:

- LEO (native Arbitrum pool on Maya Protocol)

- bLEO (BSC LEO on Pancakeswap)

- pLEO (Polygon LEO on Sushiswap)

- heLEO (Hive Engine LEO on Beeswap)

LEO buybacks from LeoDex revenue is happening primarily on the first 3 pools while the SIRP (INLEO Revenue) buys back from the heLEO pool/order book.

Fully Transparent

LeoDex Buybacks are 100% transparent. You can now track the POL Vault Address here: 0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67f.

All buybacks of LEO flow to this vault address. Whether LEO is bought on bLEO or pLEO or natively on Arbitrum, it is all bridged to its native form (LEO on Arbitrium).

- When bLEO is bought off the market, it is bridged from BSC to LEO on Arbitrum

- When pLEO is bought off the market, it is bridged from Polygon to LEO on Arbitrum

You can track the address's activity on all 3 blockchains however; you will see the final amount of LEO always arrive to Arbitrum.

- https://arbiscan.io/address/0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67f

- https://bscscan.com/address/0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67

- https://polygonscan.com/address/0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67f

Feel free to check the balances at any time and note that the bridging happens in intervals. So the buybacks will be individual TXs on Arbi/Polygon/BSC but the eventual total LEO will aggregate to Arbitrum and be prepared to stake in the new sLEO contract.

Why POL and What Does it Do?

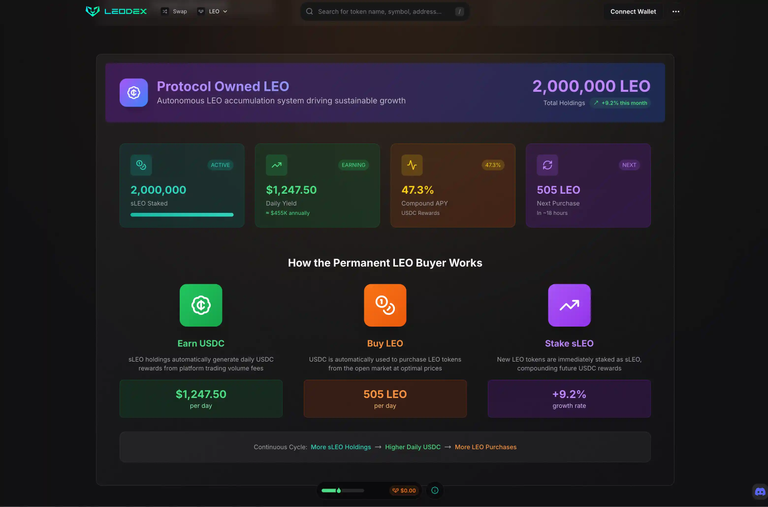

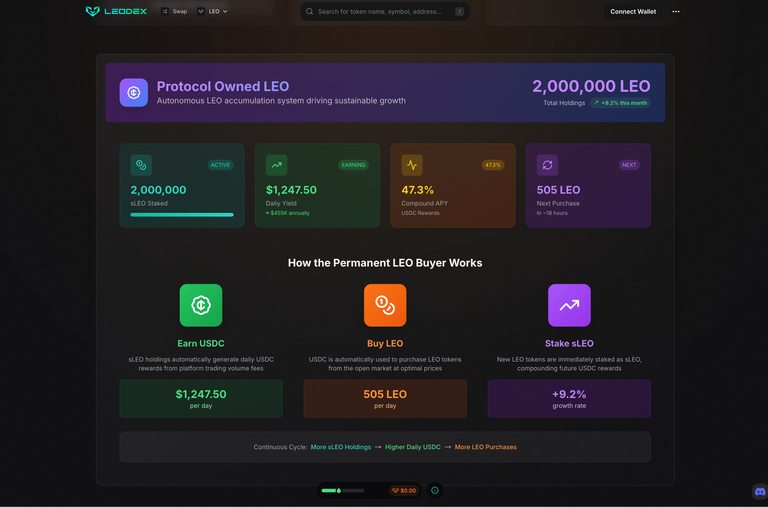

(displayed is placeholder data until the page goes live)

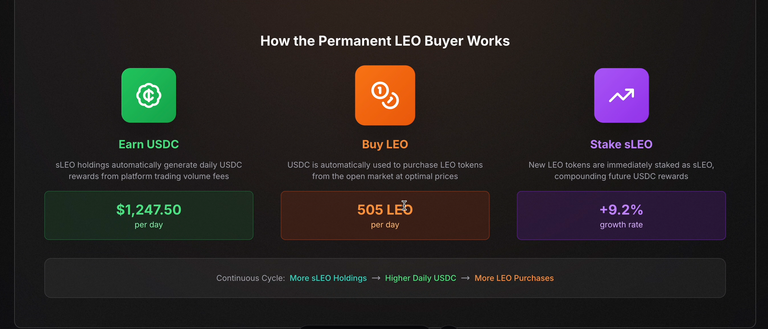

For 90 days, 100% of LeoDex affiliate revenue buysback the LEO token and then moves it to Arbitrum (Native LEO) and stakes it in the sLEO contract.

On September 25th (when the 90d buybacks end), 100% of LeoDex revenue is paid into the sLEO contract as USDC on Arbitrum.

This sLEO contract then allows LEO stakers to harvest USDC every single day.

The POL vault address earns USDC alongside all other stakers proportionally to how much LEO it has staked.

- Every day, it earns USDC and then buys LEO with it from the native Arbitrum LEO Pool on Maya Protocol.

- It then stakes the LEO it bought as sLEO in the contract -- increasing its share of the daily USDC reward the next day.

- Rinse & Repeat. Forever

This means that the POL is a permanent buyer of LEO. As long as LeoDex is continuing to process swap volume, the POL vault address is continually buying LEO with the USDC it earns. As the POL grows its share of sLEO, it earns more and more USDC to buy more LEO with. Creating a flywheel effect where it accrues more of the total LEO supply and therefore is able to accrue ever-more of it in subsequent days.

How to Track POL

The new /leo page on LeoDex will be launched soon. In the meantime, you can track POL directly onchain. We recommend simply watching the address on arbiscan to see it accrue more LEO each day (as it buys LEO from bLEO and pLEO and bridges it back to native LEO on Arbitrum): https://arbiscan.io/address/0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67f.

On the new /leo page, you'll be able to see all the LEO held by the POL Vault Address. You'll also be able to see the "Community & Activity" section. In this section, you can see the activity by the community and you can also see the POL activity specifically:

- When POL Claims USDC

- When POL Buys LEO

- When POL Stakes sLEO

All in real-time with links to track/verify it onchain.

So far, LEO's POL Vault Address has acquired 10,000 LEO and it was just turned on today. There are thousands of dollars in the affiliate address that are waiting to be deployed to buy more LEO. Every day, new volumes on LeoDex generate more USD to buy more LEO.

Exciting times. We're seeing LEO 2.0 start to shape up. LEO is currently trading at ~$0.033 (a near 2x increase from pre-LEO 2.0 levels).

Posted Using INLEO

nice work pump my leo to 1 dollar lel

I am super bullish on Leo... instead of getting out of hive people have a place to speculate and win hard! that's with LEO

nice work pump my leo to 1 dollar lel

I cannot wait to see the POL in action on LEODEX.

Why do you get wLEO out of the LEO ecosystem? Is it just because of the Ethereum (ETH) fees? If LEO is $2, then ETH fees wouldn’t be that high. We, the holders of wLEO, are in a vacuum right now. We still don’t know when we will be able to get our LEO. Why do pLEO and bLEO holders already know this?