Financial statements are very important for the management and owners of companies because they are useful for effective decision making and also because they are a reflection of the movements in which the company has incurred during a period of time.

Investors and any other person interested in the information become decision makers regarding where to invest their resources, since it allows them to know what benefits they can obtain and the profits that the company has generated.

In summary, the financial statements provide the organization with very valuable information that allows them to make decisions from several areas such as economic, administrative, financial and accounting to act in case there is any irregularity or mismanagement of assets, so that it can protect it for the future of the same, that is, to apply corrective measures to ensure an effective development of the investment or efficient use of any expenditure made.

The main financial statements that exist in the organizations are:

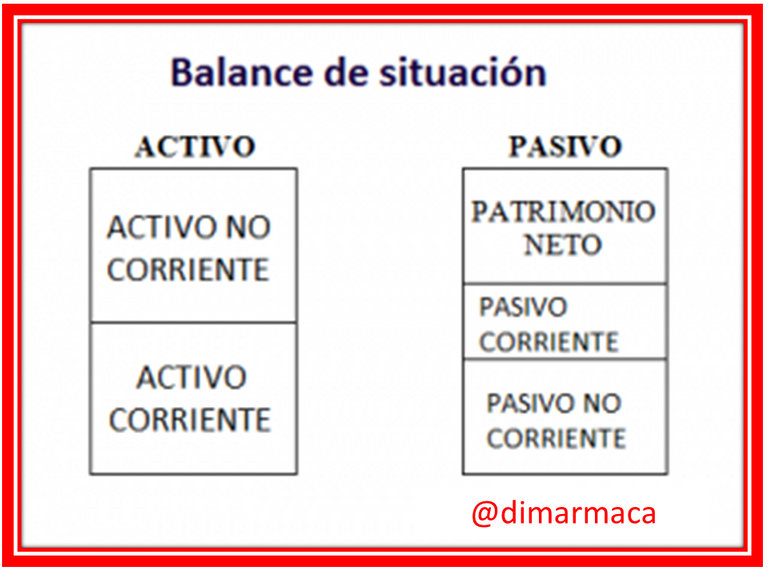

The Statement of Financial Position: This financial statement is formed by the real accounts that are all the goods, rights and obligations that the company has as well as the conformation of the capital, that is to say, we can get the current and non-current assets, the current and non-current liabilities and its equity in detail, in addition it can be constructed at any time or determined date to know the financial situation of the interested parties and its accounting formula is Assets = Liabilities + Equity.

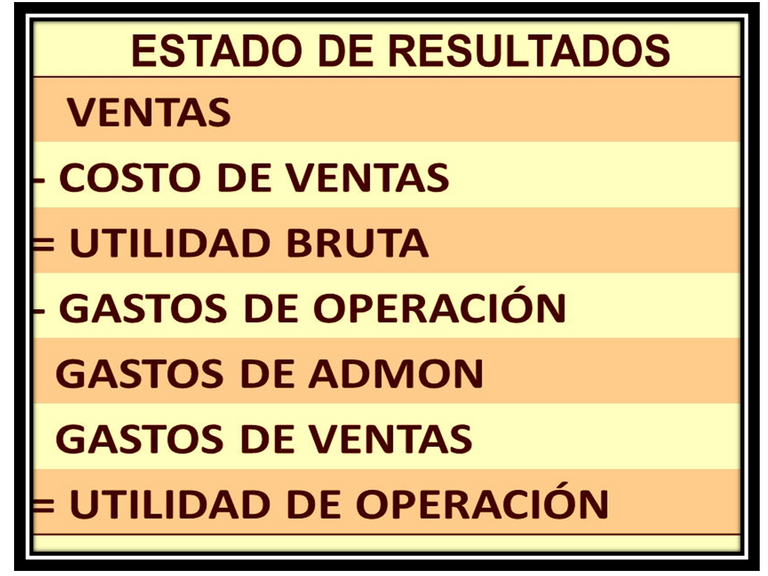

Statement of Income or Statement of Comprehensive Income: In this financial statement we can find the nominal accounts, which are made up of ordinary income and extraordinary income, the different costs incurred by the company that may vary depending on its business activity and finally the expenses, so that the comprehensive statement determines the profit that the company obtained or loss that was generated in an economic period of 12 months. The numerical values that build this financial statement are obtained from the general ledger and all its auxiliaries.

Cash flow statement: In this financial statement we can find out how the cash is formed and what capacity it has to face debts and obligations to third parties, as well as the capacity to generate cash.

It also serves to evaluate the variations that exist in the company's assets, including its liquidity and solvency, to face commitments and its capacity to adjust the dates of collections and payments of the obligations that may arise.

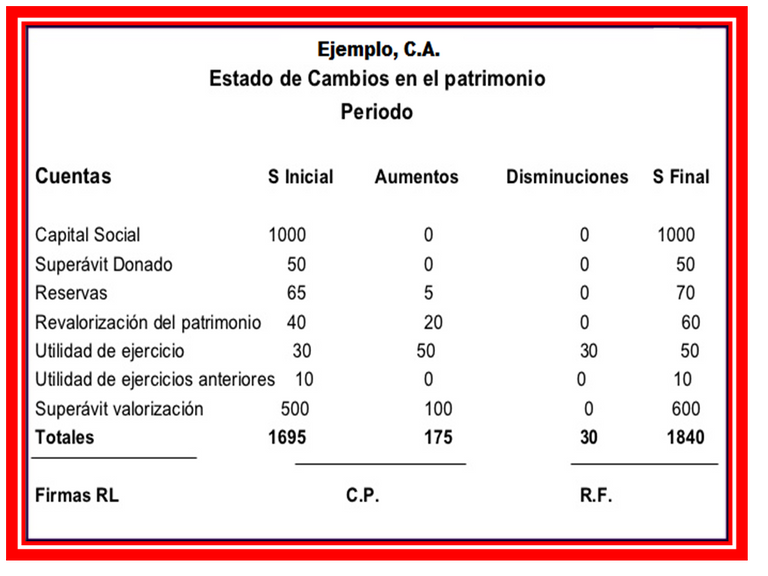

Statement of movement in equity:It is the financial statement that allows us to know the structure of the conformation of the contributions of each of the partners in the most detailed way possible, as well as the relations of the distribution of the profits that are obtained when an accounting period or economic period ends, as well as the retention of the profits retained in previous years.

Congratulations @dimarmaca! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 2750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!