The Bitcoin balance on exchanges is a parameter that is closely monitored by the market participants. It can give a signal when a large amount of Bitcoin is moved in or out of exchanges causing the price to drop or rally. In the recent period it is also monitored as proof or reserves on exchanges.

In the last period there has been a lot of talks that Bitcoin on exchanges keeps going down due to more and more companies buying Bitcoin for their balance sheet, coping the Strategy model. Let’s take a look.

Here we will be looking at:

- Bitcoin balance on exchanges

- Historical share (%) of bitcoin balance on exchanges

- Bitcoin balance on exchanges VS supply

- Monthly Changes for BTC on exchanges

- BTC on Exchanges VS Price

- Top Exchanges holding BTC

The data is collected from sources like coinglass.com, macromicro.me, cryptoquant.com.

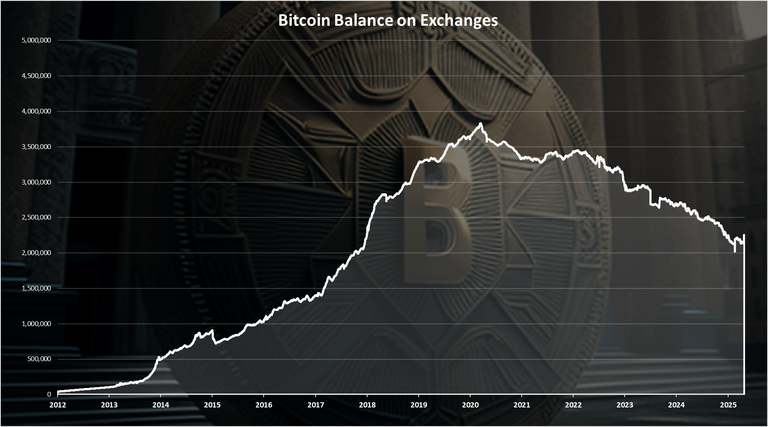

Bitcoin Balance on Exchanges

Here is the chart for the historical balance of bitcoin on exchanges.

This is a long-term trend starting from 2012. As we can see prior to 2013 the amount of BTC on exchanges is almost nonexistent. After 2013 there is an increase in the amount of BTC on exchanges, reaching more than 600k at the end of 2014. In 2015 there is a small drop and after that a continuous growth up to March 2020, when an ATH for BTC balance on exchanges was reached more than 3.5M.

Since 2020, the balance on bitcoin on exchanges is in constant decrease and it has dropped even more in the recent period. At the moment there are around 2.2M BTC on exchanges. Quite the drop since the ATH.

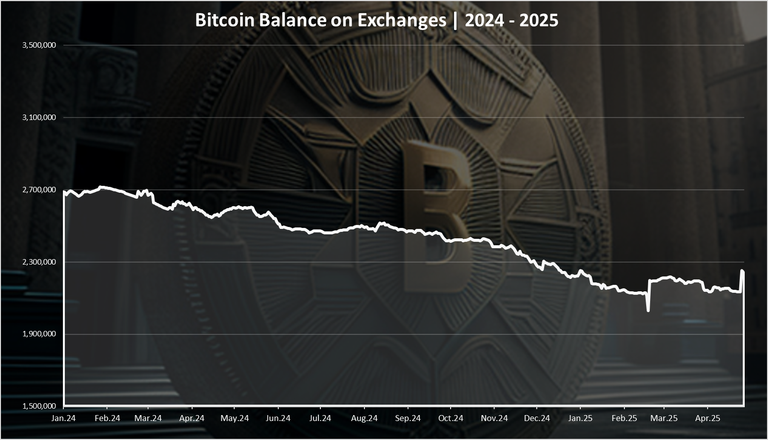

When we zoom in 2024-2025 we got this:

A continuous decline in the BTC balance on exchanges in the last years. At the beginning of 2024 there was around 2.7M, while the year ended at around 2.3M. A 0.4M reduction in 2024.

In 2025 there is a further drop in the first month, but then some volatility and ups and downs, that is corelating with the Bitcoin price in February and March of 2025, and the a big spike at the end of April 2025. If this spike didn’t happened the reduction on BTC on exchanges would have continued, but now we are sort of equal on 2025 with maybe a small drop.

Note that different source are reporting different data on the Bitcoin balance on exchanges and the current 2.2M might differ.

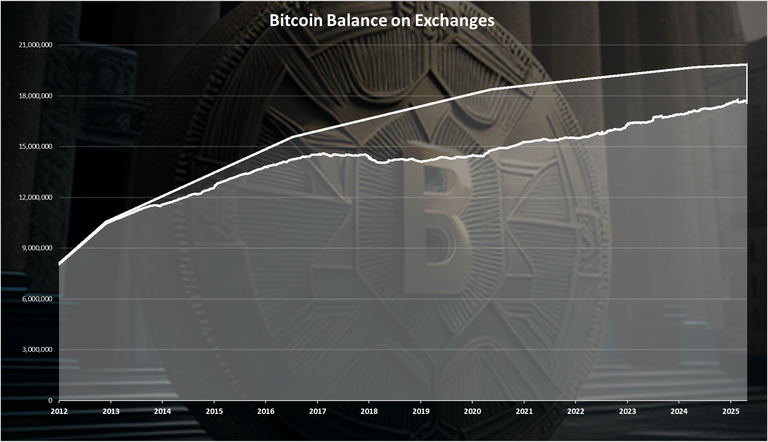

Bitcoin on Exchanges VS Supply

When we plot the balance on exchanges VS the overall supply, we get this:

We can notice the increase in the balance one exchanges up to 2020 here as well, and then a slow decrease. But still overall we can see how small this share is from the absolute supply when presented in the chart above.

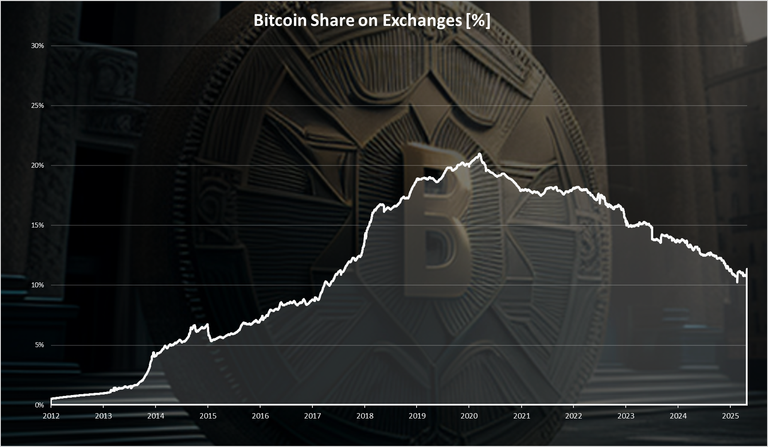

Historical Share [%] of Bitcoin Balance on Exchanges

When we take a look at the Bitcoin balance in relative terms, as percent of the supply we get this:

This chart is similar to the absolute balance, but here we can see the share [%]. An all-time high of 20%, in 2020, and a drop since then to 11% where we are now. At the beginning of 2024 this percent was close to 14%.

When presented as a pie chart the chart looks like this:

A 11% of the Bitcoin supply is currently on exchanges. This is a low amount of tokens on exchanges, especially bearing in mind that Bitcoin doesn’t have any type of staking rewards or similar incentives for users to withdraw their tokens of exchanges. The overall trend of self-custody has been growing.

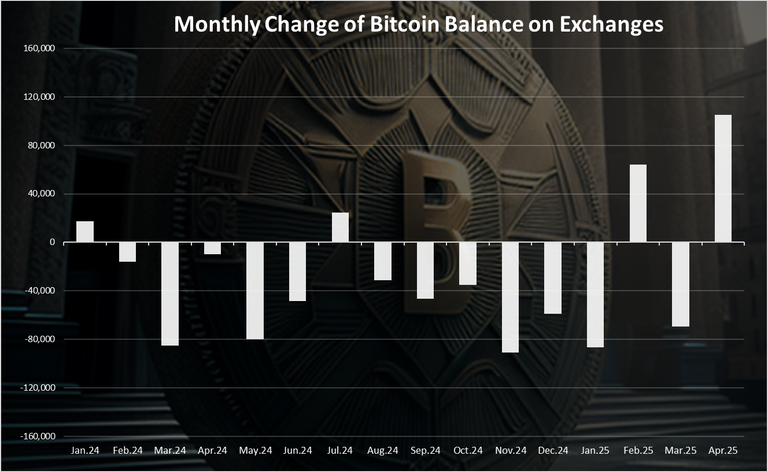

Monthly Changes for BTC on Exchanges

The change for the monthly balance on exchanges is as follows:

This is a chart for the period starting from 2024 till now. A positive bar is the inflow, negative outflow from exchanges.

We can see that last year in 2024 most of the months were negative with November been the month with the most BTC withdrawn from exchanges. Only January and July of 2024 were positive, but just by a little bit.

In 2025 January started with strong amount of BTC withdrawals, but then February was in the positive, March again down, and April up thanks to the inflow in the last few days. Quite a volatile start of the 2025.

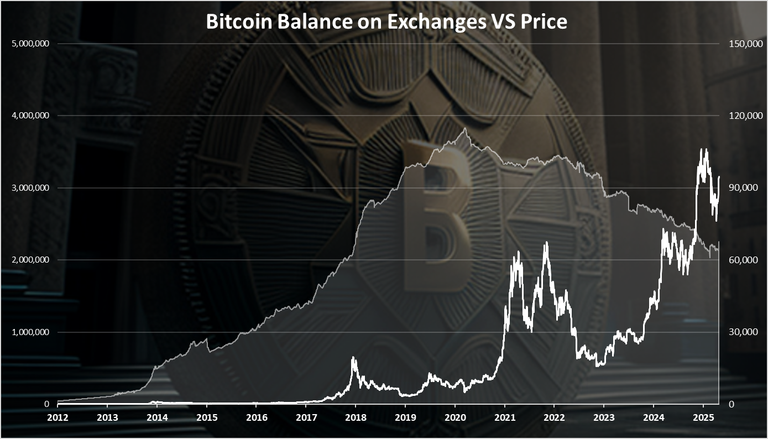

Bitcoin Balance on Exchanges VS Price

When we plot the BTC balance on exchanges vs the price we get this:

When we look at the long-term trend, we can notice that there has been a correlation back in 2017, when the price increased, that followed by a large amounts of BTC deposited on exchange, and this continued to grow even during the bear market of 2018 and 2019.

In the last bull market of 2021, there hasn’t been any significant increase in BTC on exchanges. There was only a slight increase towards the end of 2021, but then the trend for removing BTC from exchanges continued, no matter the price.

Will this trend be over soon, or it will continue in the future remains to be seen.

In the last years these two have been moving in the opposite direction. The amount of BTC on exchanges down, and the price up.

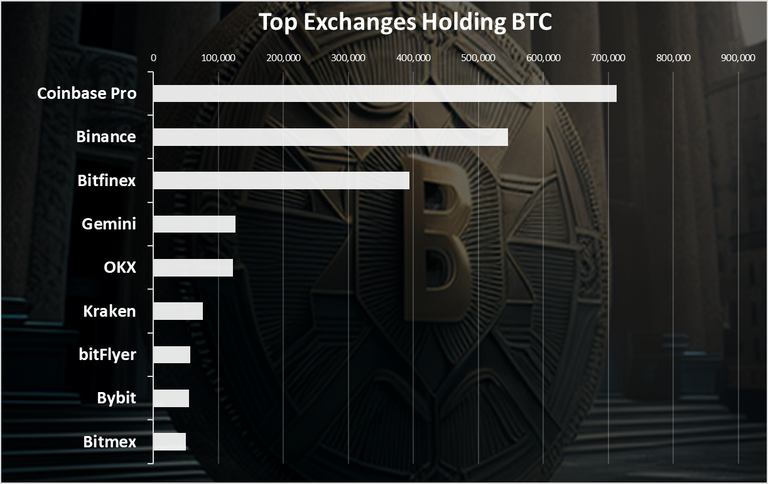

Top Exchanges Holding BTC

Which exchange holds the most BTC. Here is the chart.

The Coinbase Pro with close to 713k BTC is on the top here according to Coinglass. Not sure what is included in this amount, does Bitcoin that Coinbase custody for other entities, like maybe the ETFs. In the past this number was close to 900k.

Binance is in the second spot with close to 545k Bitcoins, followed by Bitfinex and Gemini. All these exchanges are down in Bitcoin prior to where they were six months ago.

Obviously there is some drastic movements on the exchanges in 2025 in both directions. If we get to a supply shock, things can get interesting.

All the best

@dalz

This post has been upvoted by @shortsegments and you are invited to join the bitcoin community called BitSocial: a place to talk about Bitcoin. tag #bitsocial

Link

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 390000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Sir, have you paid membership of following websites?

coinglass.com, macromicro.me, cryptoquant.com.

because I don't see these charts in free membership.

hmm exchanges are chashing out btc?

Once again, good days are starting for the market and we will see that prices are going to skyrocket after the interest rate cut. I didn't know that before, but now we are seeing that exchanges are running out of Bitcoin, so prices will definitely go up.

Again, this is a magnificent pool of data ... I think it is definitely possible that we can get a supply shock if governments start scrambling for Bitcoin ... China is talking about dumping treasuries for it ... the U.S. is floating the idea of getting enough Bitcoin to pay off the national debt ... it's just talk, but if a good bit of that pans out, with Microstrategy and other corporations also loading up, that shock could happen.