Dswap.Trade is slowly getting adopted among HIVE users. I am seeing more and more blog posts are being made and users are sharing their POV towards Dswap.Trade. It has created some major buzz and no wonder with the services that are being provided traders are making the best of it. Although users with big balance are going to make the best out of this. In my previous blog post, I shared how I used the MARKET.DCA pool and it went pretty smooth. If you would like to check it out you can see it for yourself, Trying out Dswap.Trade || My First Trade.

The concept of using Dswap.Trade is highly effective when the market is shifting. Especially, if you are buying and the market is going down. That is when you get to make the most use of it or the situation is vice versa. Also not to forget when you are buying in bulk and in one of those pairs where liquidity is not really enough in normal market pairs, this is where liquidity comes into play. As for our HIVE based tokens it is one of the issue (regarding liquidity) in normal markets. But this has been sidelined by the liquidity pools that we have in our layer 2 markets.

Since we will be doing DCA in our buying/selling orders in Dswap.Trade in Market DCA and Pools DCA, it is better to to know what is DCA and how does it usually works. Upon DYOR, it is better to dive into this platform. Or else there is a high chance anyone would end up loosing money. Also, if you are willing to bet some money in DCA most of the time you will end up winning. As in terms of HIVE, the price appreciation is much higher compared to any random tokens. As it usually goes up no matter what, it may take some time but it will eventually bounce up.

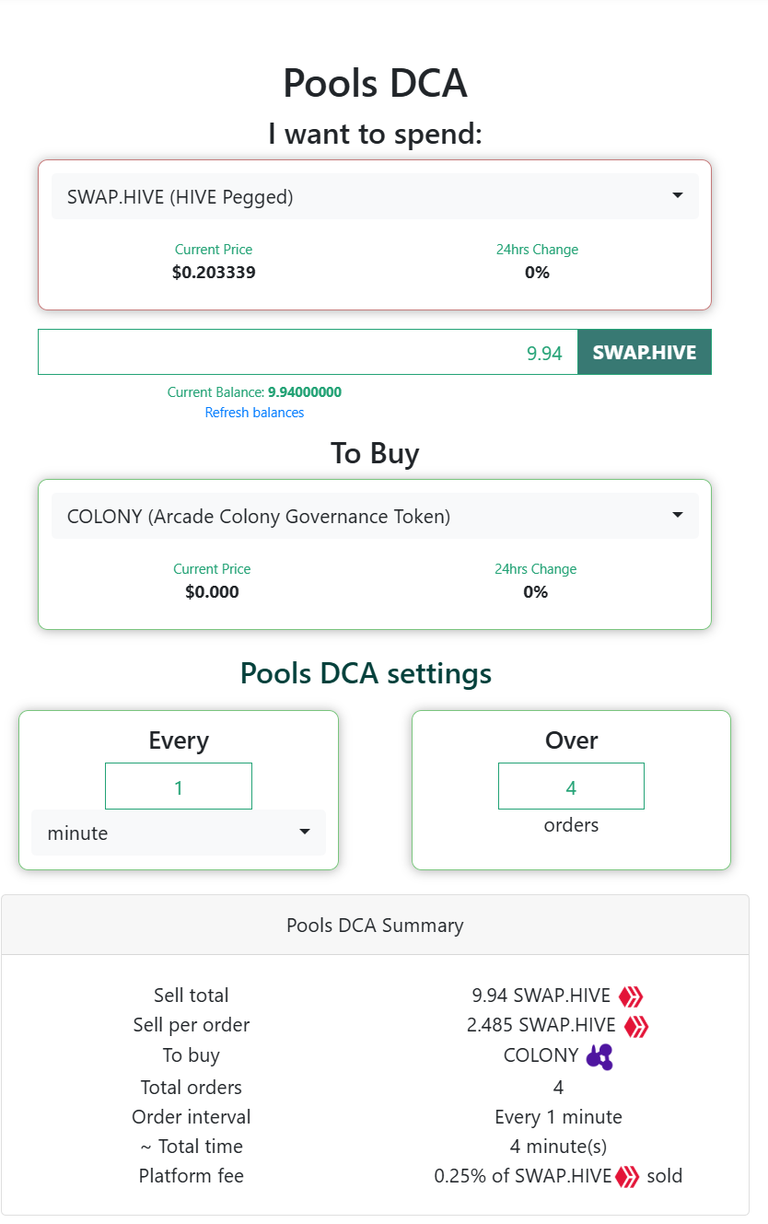

In this post, I would like to share my experience regarding the pools DCA. I was also curious to see how the price impact would be. Overall, I was sort of curious about the execution of this trade. Under normal circumstance few aspects which can be taken under consideration. Pools have proactively much more liquidity. Which allows a user to do trade much more smoothly. Also not to forget, when there is enough liquidity in any given pair or in the market you definitely would end up being in the positive side unless the market shifts in a rigorous way.

|  |

|---|

I choose the interval of a minute for this trade to go on. I am just excited to see how this would turn out with a vague amount of 9 HIVE. I would like to compare with the Tribaldex pool. As I am noticing some shift in price of HIVE. As of writing this post, HIVE is literally taking a hit and going down in price. I would say, I will be able to see some price change and it would probably negatively impact my buying.

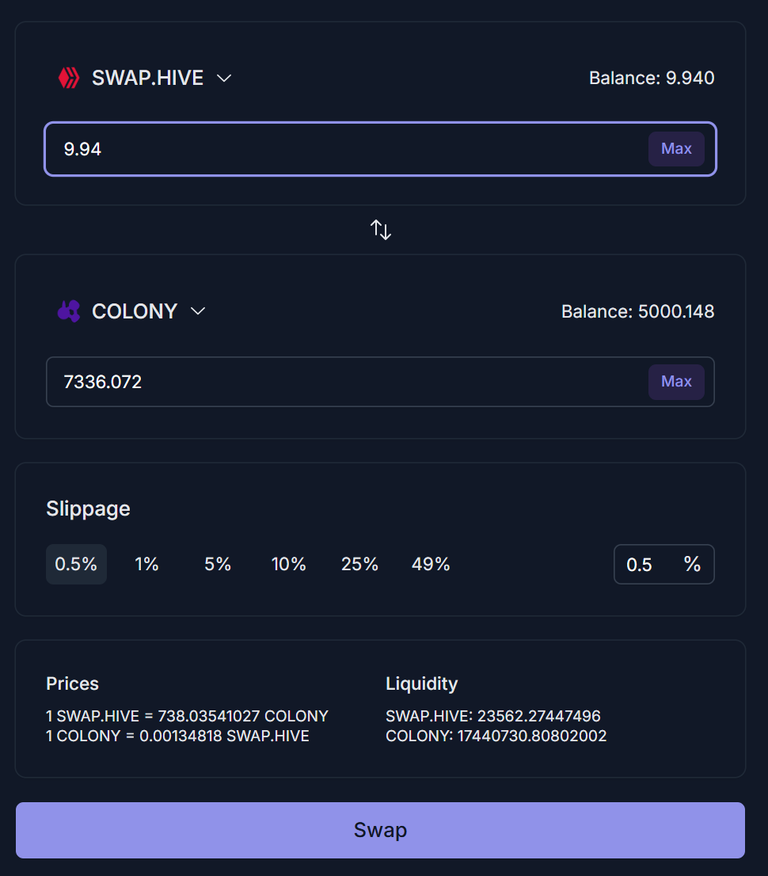

According to the charts and after commencing the output, this is what I got. In Dswap.Trade after executing 4 trades, I am got 7317 Colony Tokens. Whereas, in Tribaldex I would have got 7336 Colony Tokens. A little loss, I had to bear.

While in terms of DCA I must say, Dswap.Trade can become one of the most important tool. As if we take HIVE for example the current price is a steal. Getting HIVE at 20 cents area would literally change the POV of many users. We all know what will happen to HIVE in the coming days. It will very easily cross 25 cents mark. Which is why DCA starting from here will eventually end up in profit for sure. This is also capable for tokens which are getting some rough hit in this overall market.

I will probably add this Colony token in the liquidity pool. And would love to complete my 100k target of Colony tokens in the LP. Hopefully will achieve it very soon.

Image Source : Dswap.Trade, Tribaldex

Best regards

Rehan

Want to play & earn from Splinterlands

Join via, My Referral link