Happy Monday, frens!

It's Memorial Day in the USA, and stocks are closed today, but crypto never sleeps. Indeed, it was a relatively interesting weekend for Bitcoin and friends.

The latest movements have been macro-driven since Friday, when Trump declared that 50% tariffs for the EU goods and BTC reacted with a decline. During the weekend, Trump announced that they will postpone tariffs until the 9th of June to give some time for possible negotiations. The led BTC to jump back above previous ATH levels, and here we are:

- Higher high on 4h chart

- Stoch RSI closing in on overbought

In the short term, we could very well go higher from here, and I'm looking for BTC to pull back a bit and then create a higher low at $106.280 to confirm the uptrend.

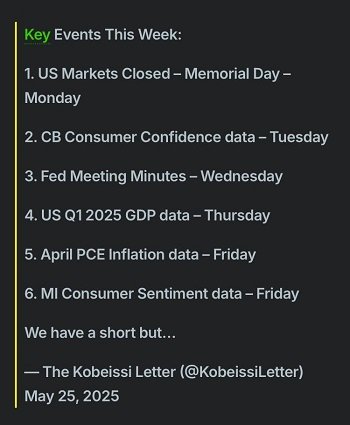

Key Events For The Week

For the rest of the week, you can see some of the important macro events happening later on that will probably add some volatility to our lives.

Also, if you are holding AI tokens, you might want to keep an eye out for the Nvidia earnings report that is released on Wednesday.

BTC Dominance

Charts affecting altcoins include the Bitcoin Dominance chart, which has been on the rise after a short-lived pullback. Then again, it also hit the resistance level at 64.32%, so we are closely watching which direction BTC.D will take from here.

$JUP

One of the altcoin spot trades I made during the weekend was $JUP, the native coin of the Jupiter DEX on Solana.

Previously, I had sold my JUP a bit too early near the top and was patiently waiting for an opportunity to buy back in.

Yesterday, $JUP had bounced back up from the support line, and I made my move. Since then, $JUP has surged 18%, which is more than I expected in the short term. As the resistance is now approaching, it's time to take some profits. Always a hard thing to do, but gotta stay consistent and prepare for a volatile week.

$HIVE

Lastly, I want to share my HIVE buy/sell chart to demonstrate how difficult it actually is to catch tops and bottoms when trading.

Yes, there have been a couple of spot-on trades, but mostly I haven't let the price action play out. It's a psychological thing, even though when you're close to your target and know that the movement will probably continue, you become hesitant and start fearing losing an opportunity to make the trade.

Then again, a couple of lost .02% won't matter as long as we hit close. Therefore, I'm learning to use zones rather than lines to mark my targets. This way, we reduce the risk of being completely played out in fast-moving markets. You could also set a bunch of limit orders within zones to start "DCAing" when in the target zone.

Conclusion

Still working on the branding and content of this daily market review, so let me know what you think, what kind of analysis you want me to include, etc. Keep following and drop your own trading ideas below! 👇

Thank you for reading, have a great week and enjoy the volatility!

Apps and Airdrops:

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Grass - $GRASS token launch surprised everyone, don't miss the second season!

Posted Using INLEO

crazy the BTC.D. Owning alts the last year hasnt paid off at all... except Monero.

Oh, man... I'd love to see that go down for good. Or at least for a while... I'm still mostly in stables but the only holding that has performed very well is $HYPE. Not holding much of it but bought btween $11 - $18.