Bitcoin's original utility was peer-to-peer electronic cash, meaning you could pay directly for goods and services with it. When it was decided back in 2017 that Bitcoin's blocksize would remain capped, it transformed into something resembling "digital gold".

In the year 2025, very few investors are transferring their Bitcoin onto the Lightning Network to use it as digital cash. In fact, these days most people who buy Bitcoin are treating it as a purely speculative asset, hoping for its price to increase as "money printer go brrrrr".

That said, Bitcoin does still have its advantages over traditional speculative assets, so long as you keep it out of ETFs and centralized exchanges. Because unlike assets that are held at banks, self-custodied Bitcoin is censorship-resistant, available 24/7/365, and accessible globally.

Ethereum's Gas Token

In dollar terms, Ethereum is the second largest cryptocurrency.

Unlike BTC, which can only be used to pay for the transaction fees required to send Bitcoin, Ethereum's ETH token can be used to access decentralized applications like DEXs, prediction markets, NFT trading platforms, governance, token minting, and more.

Some would say that ETH is more like "digital oil," when compared to Bitcoin's limited use as "digital gold".

Similar to Ethereum, other decentralized application platforms have their own version of oil (like SOL for Solana, and AKT for the Akash Network).

Application Tokens

As mentioned above, platforms like Ethereum and Solana allow anyone with sufficient gas to mint their own application tokens. Although these tokens are sometimes minted to enable decentralized governance and reward holders, oftentimes they end up becoming "shitcoins".

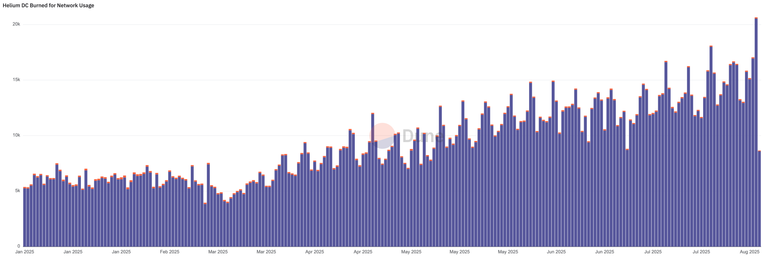

That said, there have been some innovative use-cases of application tokens in recent years, such as DePIN project Helium (HNT), which puts blockchain technology to practical use, builds real network effects, and generates actual revenue, as shown in the chart below:

The HNT token, which currently exists on the Solana blockchain, is awarded to independent wireless hotspot operators for rolling out and maintaining the network. The token can then be burnt for data credits to access the network, creating a circular economy.

The same concept is being applied to other wireless, decentralized compute, storage, and energy DePIN projects.

Since the rewards are distributed automatically and transparently using an open-source smart contract, the participants build confidence in the system, and become more invested in it over time.

A World Without Fiat

The price of cryptocurrencies correlates well with the total money supply in circulation. In other words, as more liquidity is injected into the banking system ("brrrrrr"), valuations go up. Bitcoin and Ethereum attract even more capital thanks to their ETFs, not necessarily their utility.

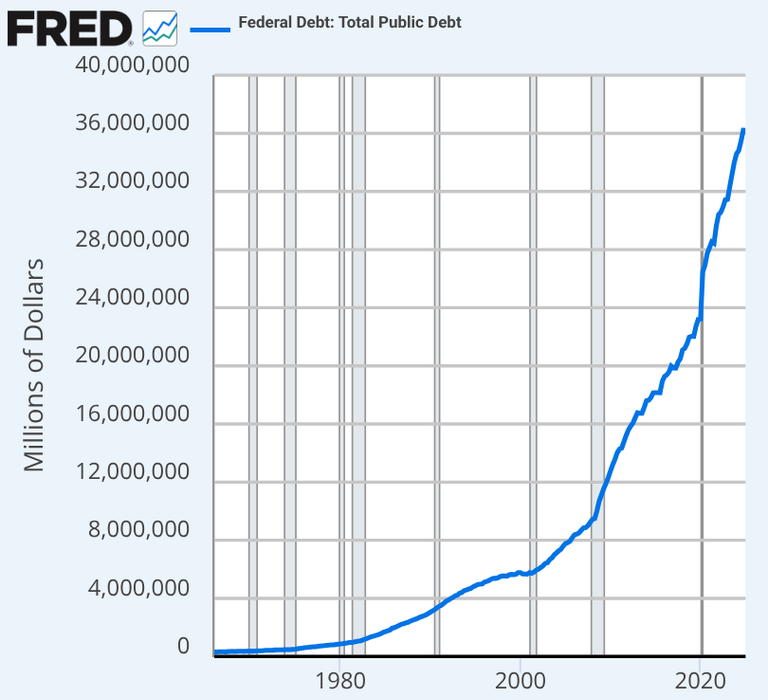

But as the federal debt and the money supply continue to grow exponentially, how much longer can this speculation persist? The debt-based fiat system is on an unsustainable trajectory, and it cannot last forever:

We know that many fiat currencies have collapsed throughout history, and are essentially worthless today (aside from their value as collectibles). Why would today's dollar system be any different from its predecessors?

Setting aside government-sanctioned CBDCs and centralized stablecoins for a moment, let's take an educated guess as to which digital tokens would be the most valuable in a world where the debt-based dollar system has become irrelevant.

Gas vs. Application Tokens

In a world where an exponential supply of dollars is no longer being used to speculate on digital assets, utility would likely become king again. In that scenario, would it make more sense to save a stockpile of gas tokens like ETH and SOL, or application tokens like HNT?

While gas tokens can be used to pay for transaction fees on things like swapping and voting, application tokens will be used to pay directly for things like wireless service, compute power, storage, energy and more. The need for gas would be small relative to application usage.

Keep in mind that an application token can become a gas token as well, if it were to branch off to its own application-specific blockchain. Such is the case with the Cosmos-based Akash Network and its AKT token, which can be used to pay for both transaction fees and compute power.

Until next time...

Once the dollar system is either deliberately phased out, or collapses under the weight of its own debt, which digital tokens will have the most value - CBDCs, digital gold, digital cash, gas or application tokens?

The people will likely choose tokens which are free to trade, and under their own control. Gas tokens are necessary to pay for transaction fees, but application tokens will give direct access to real-world services and could therefore end up holding the most value.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Sources

Helium Data Credits Burned Chart [1]

US Federal Debt Chart [2]

Money Printer Image [3]

Posted Using INLEO