A quiet week writing covered calls and bottom feeding a few uranium ideas.

Portfolio News

In a week where S&P 500 rose 4.6% and Europe rose 3.47%, my pension portfolio rose 2.32%. Biggest drag came for 9% drop in De Grey Mining (DEG.AX) - down 10% from the sale made earlier in the week. pretty clear a lot of shareholders dumped stock ahead of the record date for the merger with Northern Star Resources (NST.AX) (Apr 28). Energy Fuels (UUUU) and ASP Isotopes (ASPI) gave back a lot of prior week gains.

Big movers of the week were Azincourt Energy (AAZ.V) (50%), 29Metals (29M.AX) (30.4%), Paladin Energy (PDN.AX) (22.2%), Deep Yellow (DYL.AX) (20.6%), Lightbridge Corporation (LTBR) (20.4%), Robinhood Markets (HOOD) (20.1%), CleanSpark (CLSK) (20%), Canopy Growth Corporation (WEED.TO) (19.6%), Forsys Metals (FSY.TO) (18.7%), DevEx Resources (DEV.AX) (18.6%), ChargePoint Holdings (CHPT) (18.3%), Stem (STEM) (16.7%), Koonenberry Gold (KNB.AX) (15.4%), NANO Nuclear Energy (NNE) (15.4%), Sigma Lithium (SGML) (15.4%), Stroud Resources (SDR.V) (15.4%), Global Atomic Corporation (GLO.TO) (14.7%), Elevate Uranium (EL8.AX) (14.6%), Volkswagen (VOW.DE) (14.4%), Aura Energy (AEE.AX) (14.3%), enCore Energy (EU) (14.3%), NuScale Power Corporation (SMR) (14%), Delivra Health Brands (DHB.V) (12.5%), NVIDIA Corporation (NVDA) (12.4%), Advanced Micro Devices (AMD) (10.4%)

25 stocks in the big movers list with several big themes represented. From the top - uranium (9 stocks), battery materials (2 stocks), nuclear technology (3 stocks), cannabis (2 stocks), alternate energy (2 stocks), gold/silver mining (2 stocks). Good to see 2 semiconductor stocks in the list and some financial markets joy in Robinhood (HOOD) and Europe Automotive. That tells me the tariff story is progressing toward deals.

US markets shook off the doldrums with the changing trade rhetoric - headline writers taking quite different views on the same data - marked up in the image

Crypto rebounds

Bitcoin price pushed through the range it has been in for two weeks ending the week 7.5% higher with a trough to peak range of 11%

Ethereum price tried to break below the range but found buyers there ending the week 8.2% higher with a trough to peak range of 20.9% = maybe the end of the wobbles

That through got me looking at momentum indicator (MACD in the bottom panel) - there is divergence here = the tide may be turning

A few spike charts around - New Economy (XEM) spiking 80% and then settling about 25% up

Enjin (ENJETH) continued last week's run up 74% before giving a lot away

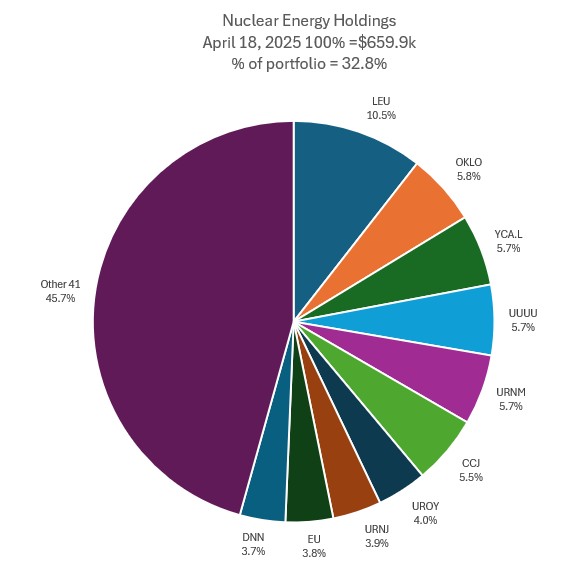

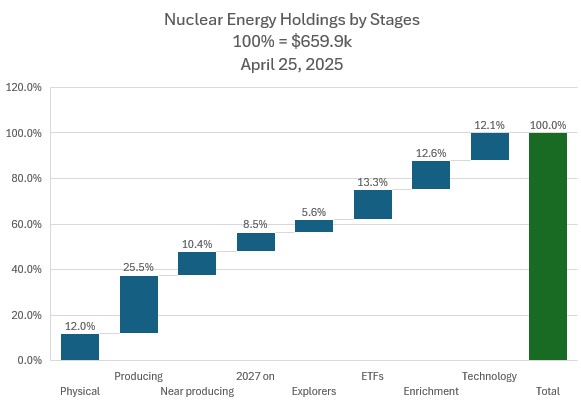

Nuclear Energy Holdings

A few additions in ASX and in Canada and a telling 5.3% increase in valuations. Another small change in opening balance - was missing a small holding in one of the additions made.

A few mix changes on the valuation moves with Oklo (OKLO) rising two places into slot 2 effectively changing places with Energy Fuels (UUUU). EnCore Energy (EU) comes into top 10 in slot 9 displacing Van Eck Nuclear ETF (NLR). Holdings also go up more than half a point to 32.8%. Do have one pending sell order in place which will pull that down - stock moved the wrong way for that.

Largest change in the holdings by stage is Near Producing up half a point. Looking in the details of the core data, will need to change categorisation of Global Atomic (GLO.TO). Mining Stock research I used had them producing starting in 2026 - not looking likely given the financing is still not decided.

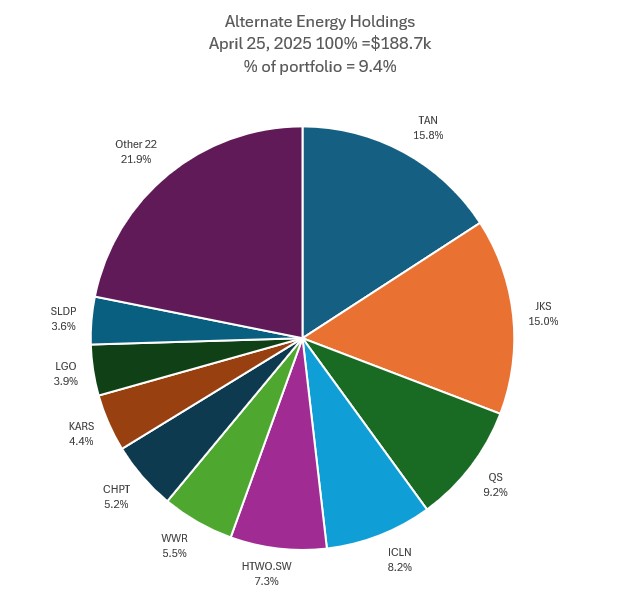

Alternate Energy Holdings

No changes in holdings or in the mix of holdings. Portfolio value did rise by 4.5% and is 9.4% of the holdings. Something got mixed up in last week data - did a recalc this week.

Bought

Global Uranium and Enrichment (GUE.AX): Uranium. Share placement announced in March at 9% discount to market - price has slid below the price paid. There were no attaching options on the placement - would have been cheaper to buy stock in the market and skip the placement. Company is developing Tallahassee Uranium Project comprising five major uranium deposits in Colorado as it main asset. Also a cornerstone shareholder in Ubaryon, a private Australian company which owns 100% of a next generation enrichment technology.

NVIDIA Corporation (NVDA): US Semiconductors. Added to holding in personal portfolio on selloff day.

Deep Yellow Limited (DYL.AX): Uranium. Deep Yellow released March quarterly report - market was underwhelmed on a down day. Project launch has been delayed (not new news), balance sheet is strong and administrative costs are under control. Resources estimates are pushing to a 30 year life of mine for Tumas, Namibia - not too many of those around.

Anfield Energy Inc (AEC.V): Uranium. Doubled holding in pension portfolio to scale in on the rising sentiment and on the back of NASDAQ listing momentum.

With uranium stocks finding buyers felt it was time to start putting on some longer term bullish trades using call spread risk reversals further out in time

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread] In both these trades, the net premium was only partly funding the call spreads

Uranium Royalty Corp (UROY): Uranium. With price opening at $1.87 put on October 2025 2/2.5/1.5 call spread risk reversal. This offers 275% maximum profit potential on the call spread for a 33.7% move in price. Profit potential scales up to 1350% with 19.8% coverage on the sold put.

Let's look at the chart which shows the bought call (2) as a blue ray and the sold call (2.5) as a red ray and the sold put (1.5) as a dotted red ray with the expiry date the dotted green line on the right margin. A blue arrow price scenario will see this trade win comfortable before expiry. Price is showing the formation of an inverse head and shoulders but has not yet crossed the neckline and the moving averages have not crossed over - so not quite solid from a technical charting point of view. The MACD momentum indicator in bottom panel is showing divergence is conformed - what instinct was telling me - is confirmed

Options chain shows my trade was the volume for the day

Energy Fuels (UUUU): Uranium. With price opening at $4.75 put on October 2025 5/8/4 call spread risk reversal. This offers 456% maximum profit potential on the call spread for a 68% move in price. Profit potential scales up to 6100% with 15.8% coverage on the sold put.

Let's look at the chart which shows the bought call (5) as a blue ray and the sold call (8) as a red ray and the sold put (4) as a dotted red ray with the expiry date the dotted green line on the right margin. Price is going to need two of the green arrow price scenarios to win - a blue arrow price scenario will be better. Price is showing the formation of an inverse head and shoulders but has not yet crossed the neckline and the moving averages have not crossed over - so not quite solid from a technical charting point of view. Charts look remarkably similar - also MACD divergence.

Sold

De Grey Mining Limited (DEG.AX): Gold Mining. Sold a portion in pension portfolio to fund next month's pension - do have a large holding and not totally keen to exchange for shares in Northern Star Resources (NST.AX) in the upcoming merger. 4,607% profit on oldest holding - accountant will do it this way. 2,382% profit on the latest tranche. This is likely to be the world's largest mine when mining begins

ASX Portfolio

No transactions - did collect a few dividends

Income Trades

59 covered calls written across 4 portfolios (UK 1 Europe 3 US 52 Canada 3 )

Naked Puts

Puts sold on stocks happy to hold at lower entry prices

- Coeur Mining (CDE): Silver Mining. Return 2.2% Coverage 27%

- VanEck Gold Miners ETF (GDX): Gold Mining. Return 1.2% Coverage 14.5%

- Gevo (GEVO): Specialty Chemicals. Return 9% Coverage 20%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 4.6% Coverage 47%

- Nokia Oyj (NOK): Network Equipment. Return 3.4% Coverage 1.6%

- Sigma Lithium Corporation (SGML): Lithium. Return 6.6% Coverage -1.3%

- Oklo (OKLO): Nuclear Technology. Return 6.4% Coverage 7.7%

Puts sold on stocks that could be assigned on covered calls - a bit early but happy to hold the stock

- Invesco (IVZ): Asset Management. Return 3.9% Coverage -3.5%

Kicked the can down the road on sold puts to preserve capital

- Builders FirstSource (BLDR): Building Products. 20% profit on buy back. 4.1% cash positive.

- Honeywell International (HON): US Industrials. 20% loss on buy back. 10.5% cash positive.

Credit Spreads

New spreads

- VanEck Junior Gold Miners ETF (GDXJ): Gold Mining. ROI 62% Coverage 1.9% - written tight - happy to enter at this level

- Robinhood Markets (HOOD): Asset Management. ROI 30% Coverage 13%

Exercise risk on pension portfolio is above current cash levels - a few sold puts to kick down the road. One credit spread is trading TTB - VanEck Junior Gold Miners ETF (GDXJ).

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 21-25, 2025

#hive #posh

Looks like you had quite the eventful week with uranium plays and strategic trades! The call spread risk reversals on UROY and UUUU seem particularly bold - here's hoping those inverse head and shoulders patterns play out nicely. Smart move taking profits on DEG before the merger too. Your portfolio's uranium focus continues to fascinate, especially with nuclear energy valuations ticking up. The crypto rebound was a nice bonus as well - that MACD divergence on ETH looks promising. Wishing you continued success navigating these markets!

#hive