Another quiet week riding some of the uranium momentum and adjusting a few tricky naked puts.

Portfolio News

In a week where S&P 500 rose 2.93% and Europe rose 2.52%, my pension portfolio rose only 1.68%. Drags were alternate energy in US and on ASX and not enough invested in Europe.

Big movers of the week were Panther Metals (PNT.AX) (38.5%), Ainsworth Game Technology (AGI.AX) (31.8%), Baselode Energy (FIND.V) (27.3%), Boss Energy (BOE.AX) (26.5%), Global Atomic Corporation (GLO.TO) (24.3%), Stem, Inc. (STEM) (24%), Bannerman Energy (BMN.AX) (22.1%), Silex Systems (SLX.AX) (17.7%), New Frontier Minerals (NFM.AX) (16.7%), Global Uranium and Enrichment (GUE.AX) (16.1%), Deep Yellow (DYL.AX) (15.1%), Elevate Uranium (EL8.AX) (14.9%), Mineral Resources (MIN.AX) (14.6%), Blue Star Helium (BNL.AX) (14.3%), Pepper Money (PPM.AX) (14.2%), Nickel Industries (NIC.AX) (13.6%), Cauldron Energy (CXU.AX) (12.5%), Paladin Energy (PDN.AX) (11.9%), HelloFresh (HFG.DE) (11%), Alligator Energy (AGE.AX) (10.7%), Oklo (OKLO) (10.5%), Capral (CAA.AX) (10.1%)

22 stocks in the big movers list with a few big themes represented - from the top - alternate energy (4 stocks), uranium/nuclear (12 stocks), rare earths (1 stock)

US markets wanted to be nervous to start the week but got pushed ahead by solid tech earnings, rumours of trade deals (including China) and a strong jobs report.

Crypto Drifts

A quiet week for Bitcoin price pushing higher to touch $98K but ending 0.7% lower with a peak to trough range of only 5.3%

Ethereum price pushed higher too and then ran out of steam ending 0.2% higher with a peak to trough range of 8%

One news item sees Litcoin (LTC) jump 10% on the potential of getting approval for an LTC ETF and then giving it away when the decision was postponed by SEC - checking fraud possibilities they say

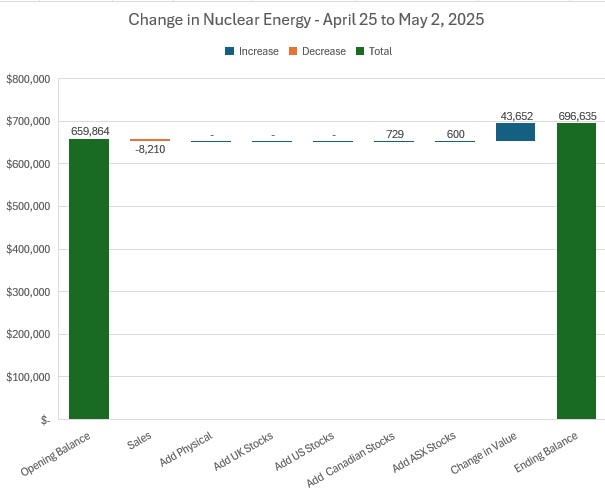

Nuclear Energy Holdings

One sale and two additions are the changes this week but more noticeable is 6.6% increase in valuations.

Mix of holdings sees Energy Fuels (UUUU) drop two places to slot 6. Sprott Junior Uranium Miners ETF (URNJ) moves up one place to slot 7. Shae of portfolios jumps to 33.8%. Time is coming to trim this - waiting for more profit windows opening.

Changes in the holding by stage sees a drop in technology from the sale there and an increase in Near Producing on value change there

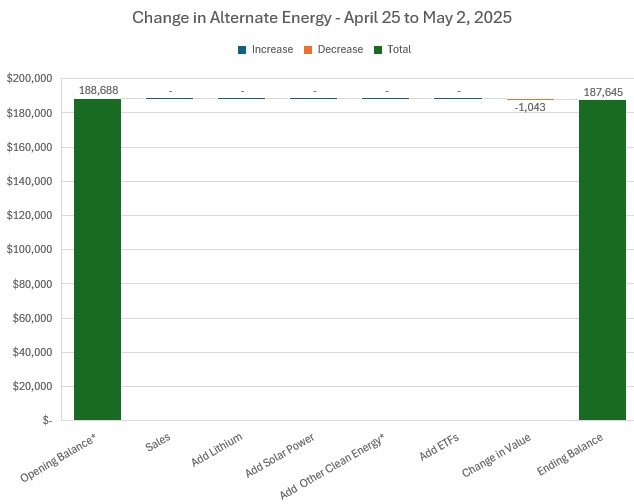

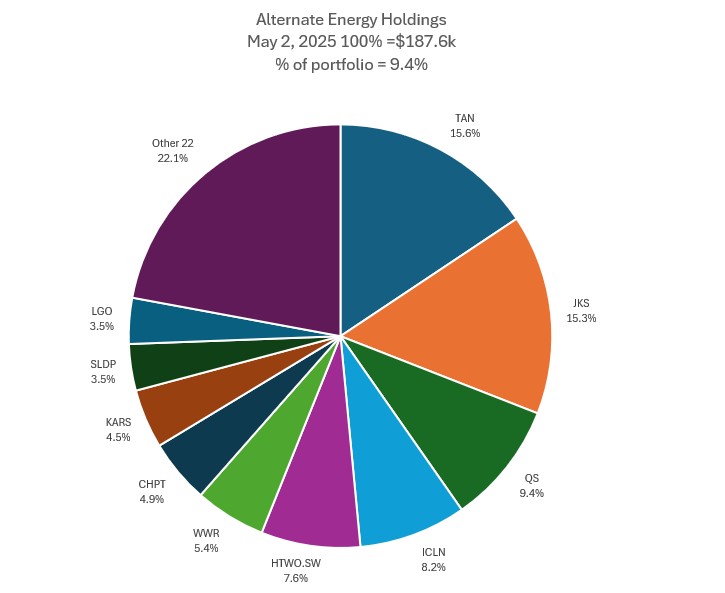

Alternate Energy Holdings

No changes in the holdings and a 0.6% drop in valuations.

In the mix of holdings Solid Power (SLDP) swaps places with Largo (LGO) in slot 9.

Bought

Strike Energy Limited (STX.AX): Australian Gas. Scaled into holding in personal portfolio. Strike Energy is in the middle of a strategic review and have a new CEO. They are also in the process of building a gas power station (earthworks have begun) in Western Australia. Gas prices in WA are a bit on the slide but power demand is growing - feels like a good pivot.

In TIB745, the rationale for the trade was potential for being taken over - that is not happening (yet) - a chart bobbing along the bottom were the words.

The updated chart since the Feb 2025 trade shows price plumbing below the lower support level and recovering. Timing of the scaling in was to ride the bounce from the 2nd test of the support level. There has been a broker target revision downwards - a 50% trade if that target is met.

Elevate Uranium Ltd (EL8.AX): Uranium. Scaled into holding in personal portfolio with a sense that rising uranium sentiment will raise all the ships. Elevate has large deposits in Koppies, Namibia at low depth and close to other mine infrastructure.

Chart shows that price has been making higher lows and forming something of a pennant. These tend to break aggressively when they do break. The blue ray is the entry price and the start of the ray is trade date - looks like this was a good call. Have mapped Sprott Uranium Miners ETF (URNM) to show the gap that had formed - 20 percentage points at trade time (now mostly closed).

F4 Uranium Corp (FFU.TO): Uranium. Scaled into holding in pension portfolio. This holding came from the spin off out of F3 Uranium (FUU.V) and had not been scaled up in this portfolio - same thought here - rising boats.

NuScale Power Corporation (SMR): Nuclear Technology. With price opening at $17.58, bought a June expiry 18/21/16 call spread risk reversal. With net premium of $1.12, the call spread offers maximum profit potential of 168% for a 19.5% move in price. The net premium is fully funded by the sold put (16) with 9% price coverage.

Let's look at the chart which shows the bought call (18) as a blue ray and the sold call (21) as a red ray and the sold put (16) as a dotted red ray with the expiry date the dotted green line on the right margin. Price has broken the downtrend and made 2 higher lows. A rerun of a blue arrow price scenario will see the trade reach maximum profit. Two concerns - the sold put (16) is above the last higher low and there are earnings coming up (the E's along the bottom axis)

Sold

ASP Isotopes Inc (ASPI): Nuclear Technology. Closed parcel of shares to lock in profits for 33% blended profit since October 2024/February/March 2025 in pension portfolio. The sale made to free up capital until next options expiry. With price closing at $5.83 (May 2) there is a chance the June expiry strike 6 sold put options could be assigned. Must say I have a degree of confidence price will rise above $6 by June 20.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Resolute Mining Ltd (RSG.AX): Gold Mining. Have been burned a few times on investments in West Africa - chose to take up this opportunity after closing out a few gold mining holdings in the last month or so. Assets are split across tow countries - Mali and Senegal. Mali has been a problem child for me over the years. With AISC of $1,708/oz, a good profit earner in a rising gold price environment.

Chart shows plenty scope to reach 35% profit target.

Income Trades

11 covered calls written across 4 portfolios (Europe 1 US 10)

Naked Puts

ASP Isotopes (ASPI): Nuclear Technology. Bought back one tranche well in-the-money sold puts to bank the profits and to preserve exercise capital = 33.7% profit on the tranche

Sold puts on stocks that could be assigned on covered calls

- Coty Inc. (COTY): US Consumer Products. Return 4% Coverage 0.4%

- Invesco Ltd. (IVZ): Asset Management. Return 3.9% Coverage -0.6%

- ING Groep N.V. (INGA.AS): Dutch Bank. Return 1.4% Coverage 1.5%

Kicked the can down the road on sold puts to reduce exercise risk

- ASP Isotopes (ASPI): Nuclear Technology. 35% profit on buy back. 29% cash positive

- Global X Lithium & Battery Tech ETF (LIT): Lithium. 17% profit on buy back. 2.4% cash positive

Lightbridge Corporation (LTBR): Nuclear Technology. With price opening at $9.73, took the opportunity of selling a May expiry 10 strike put option offering an entry price 5.4% below the open. That entry would bring down average cost of holding in pension portfolio.

Credit Spreads

One spread trading through the bottom (TTTB) on VanEck Junior Gold Miners ETF (GDXJ).

Chart shows the risk of thinking a trade will run with momentum - this ran out of steam on the day the trade was set up. Thinking is to sell the bought put (62) and wait a few days before adjusting the sold put (65). The challenge is that there is not much liquidity - the options chains shows this trade is the open interest.

Lesson learned - do trades like this on VanEck Gold Miners ETF (GDX) where liquidity is better

A different take is to just let this run to expiry - the risk is capped - the next chart shows a Stochastic RSI indicator which shows the stock is oversold. Each time it reverses the move is quite aggressive. Will be watching this at each market open.

Exercise risk across the portfolios is within margin limits - there will be work to do next month as pension portfolio total exercise risk is above cash margin.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

April 28 - May 2, 2025

#hive #posh