An up week for uranium while markets went all choppy - profits in gold and uranium banked. Lots of sold puts adjusted.

Portfolio News

In a week where S&P 500 dropped 0.43% and Europe dropped 0.12%, my pension portfolio rose 1.97%. The heavy lifting from nuclear stocks and uranium.

Big movers of the week were Coeur Mining (CDE) (47.6%), Grand Gulf Energy (GGE.AX) (33.3%), Lifeist Wellness (LFST.V) (28.6%), Lightning Minerals (L1M.AX) (28%), Centrus Energy (LEU) (27.5%), Core Nickel Corp (CNCO.NE) (25%), Tabcorp Holdings (TAH.AX) (23.9%), Resolute Mining (RSG.AX) (21.2%), Tyro Payments (TYR.AX) (18.7%), St George Mining (SGQ.AX) (18.2%), 3D Systems Corporation (DDD) (17.9%), Bannerman Energy (BMN.AX) (17.1%), Solid Power (SLDP) (17.1%), Hercules Metals (BIG.V) (16.9%), Elevate Uranium (EL8.AX) (16.7%), Fiverr International (FVRR) (15.8%), Pan American Silver (PAAS) (15.6%), Deep Yellow (DYL.AX) (14.4%), Kelsian Group (KLS.AX) (13.2%), Robinhood Markets (HOOD) (12.5%), GoGold Resources (GGD.TO) (12.4%), Delivra Health Brands (DHB.V) (11.7%), Boss Energy (BOE.AX) (10.3%), Dyno Nobel (DNL.AX) (10.3%), ASP Isotopes (ASPI) (10.2%), GoviEx Uranium (GXU.V) (10%)

26 stocks in the big movers list. A few of the big themes showing - from the top - gold/silver mining (5 stocks), marijuana (2 stocks), alternate energy (3 stocks), nuclear/uranium (7 stocks), rare earths (1 stock). A few earnings related and news related moves - key news was around potential for a speeding up on nuclear power stations in US

US markets were choppy all week even with solid earnings from many stocks. There was enough positive news flow - surprising that market did not move up

Federal Reserve chose to hold rates steady - a dovish statement from Jerome Powell did not scare anybody.

Crypto Climbs

Bitcoin price pushed higher finishing the week 10.3% higher than the open with a trough to peak range of 12.3%.

Ethereum price diverged after the completed the soft fork ending the week 40% higher with a trough to peak range of 48%

A few surprising moves up against Bitcoin given it moved strongly in the week. There looks to be a bottming happening.

Examples Polkadot (DOTBTC) up 27% - - may break the downtrend off a base

Eos (EOSBTC) up 37% and giving a third away

Injective Protocol (INJBTC) up 45%

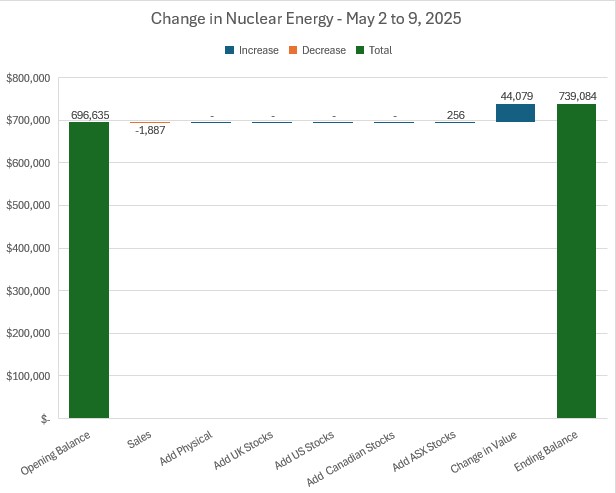

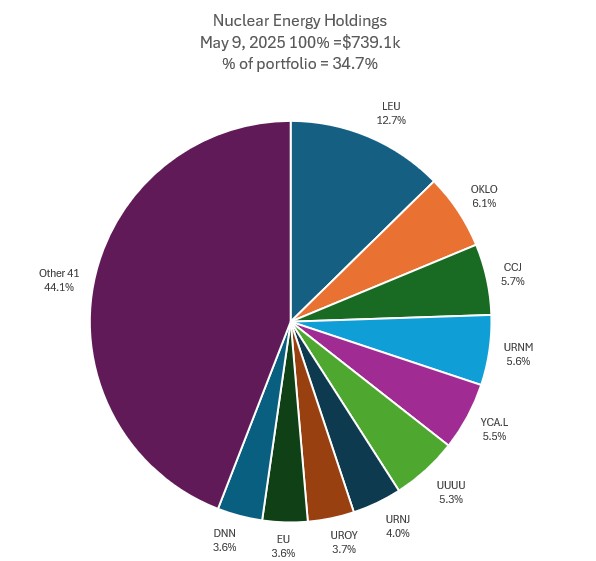

Nuclear Energy Holdings

A few changes in holdings with one sale and the modest auto-invest in ASX Sharesies portfolio. The sizeable action is 6.3% increase in valuation - not bad in a week markets went down.

Big changes in the mix of holdings with portfolio share jumping to 34.7%. Most notable is 2.2 percentage jump for Centrus Corp (LEU). Cameco Corporation (CCJ) jumps 3 places to slot 3. ETF's are on the move with Sprott Uranium Miners ETF (URNM) jumping one place into slot 4 and Sprott Junior Uranium Miners ETF (URNJ) also up one place into slot 7. Share of others drops 1.6 points.

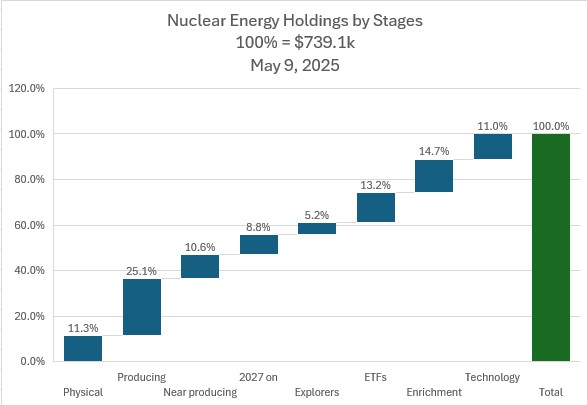

Holdings by stage saw notable change with the jump in valuation in Enrichment (up 1.8 points) and Technology (up 0.2 points). Losing share were in the first 3 columns - equally split.

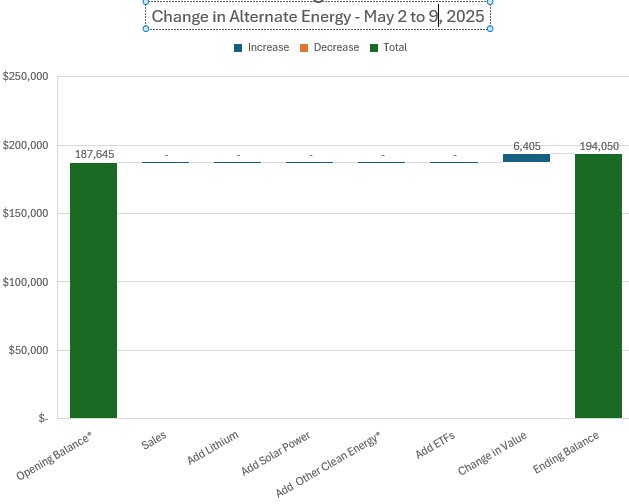

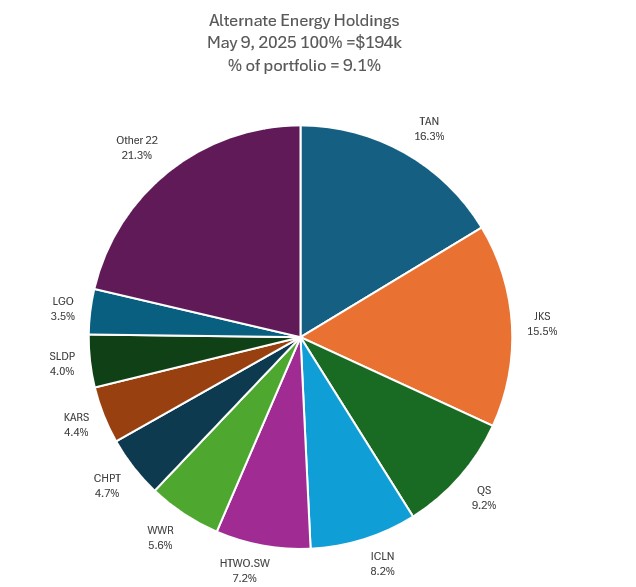

Alternate Energy Holdings

No changes in holdings but a 3.4% jump in valuation

No change in mix of holdings but the top two solar stocks add 0.9 points between them. Share of portfolios drops 0.2 points - despite that valuation jump.

Bought

Builders FirstSource (BLDR): Building Products. Assigned 5 weeks early on sold put. Breakeven after last 5 months of sold puts is $110.28 vs $111.07 close (May 8). TSP idea but they exited some time back. Wrote a covered call for 1.2% premium on breakeven with 13.3% price coverage

Euro Manganese (EMN.AX): Manganese Mining. Participated in the share purchase plan at a discount to VWAP. This time price stayed above the SPP level as the discount was substantial.

Sold

Koonenberry Gold Limited (KNB.AX): Gold Mining. Closed half the holding to lock in profits - seen too many of these resource investments trade strongly and then fall over - change of approach time. 466% profit since October 2024 - Next Investors Idea.

The chart is a good example of what can happen. From the 2022 highs price dropped over 95%. Entry was where the green arrow is => time to lock in some of the rise and then let the rest run.

Deep Yellow Limited (DYL.AX): Uranium. Reduced size of holding to take profits out of the trade. There are sure to be times to buy back lower if the FID gets postponed again. Locks in 75% profit in personal portfolio on FIFO basis since August 2023.

De Grey Mining (DEG.AX): Gold Mining. Merger with Northern Star Resources (NST.AX) completed - share for share swap with no capital gains tax event. Merged entity now adds an operating gold resources to the potential of the Hema project in the Pilbara, Western Australia. Might reduce the need for capital raising - there have been a few along the way

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

AutoInvest

$600 spread across 4 uranium stocks, one gold ETF and two index ETFs - first part of the series done this week.

Uranium

- Silex Systems Limited (SLX.AX): Uranium.

- Global X Uranium ETF AUD (ATOM.AX): Uranium.

- Deep Yellow Limited: Uranium.

- Global Uranium and Enrichment (GUE.AX): Uranium.

- Terra Uranium (T92.AX): Uranium.

Indexes

- VanEck Gold Miners ETF (GDX): Gold Mining.

- Vanguard Australian Shares Index ETF (VAS.AX): Australian Index. Yield 3.4%

- Vanguard MSCI Index International Shares ETF (VGS.AX): International Index. Yield 3.2%

Shorts

CleanSpark (CLSK): Bitcoin Mining. Trading error resulted in creating a reverse calendar put spread - effectively long May expiry 10 strike put funded by a June sold put. Put in a pending order to sell but the rising Bitcoin price has price moving up (not down).

Income Trades

10 covered calls written across 4 portfolios (UK 2 Europe 1 US 7)

Northern Dynasty Minerals (NAK): Gold Exploration. Been writing covered calls for quite some time to recover some of the capital. Stock price is around $1 - holding is a lot of contracts. This week - one trade had 56% commissions - rip off - but free money is free money on a stock going nowhere fast. In gets worse, in managed portfolio the commission was higher than the premium. Time the sponsor worked out that a liquid options markets is actually good for a stock - negotiate a better deal on commissions.

Naked Puts

Sold puts on stocks happy to own at lower entry price

- Sprott Uranium Miners ETF (URNM): Uranium. Return 3.8% Coverage 2.6%

- Sprott Uranium Miners ETF (URNM): Uranium. Return 2.3% Coverage 8.8% - lower strike

- Oklo (OKLO): Nuclear Technology. Return 3.45% Coverage 16.5%

- Loop Industries (LOOP): Specialty Chemicals. Return 7% Coverage -2% - positive breakeven will reduce average cost

Sold puts on stocks likely to be assigned on covered calls

- iShares MSCI Germany ETF (EWG): Germany Index. Return 0.38% Coverage 4.6%

- enCore Energy Corp. (EU): Uranium. Return 4% Coverage 8.7%

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 1.7% Coverage 10% - pension portfolio

- Cameco Corporation (CCJ): Uranium. Return 1.1% Coverage 7.9%

- Denison Mines Corp. (DNN): Uranium. Return 3.3% Coverage 2.7%

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 1.9% Coverage 10% - managed portfolio

- JDE Peet's N.V. (JDEP.AS): Europe Coffee. Return 1.8% Coverage 2%

- HelloFresh SE (HFG.DE): Europe Restaurants. Return 1.06% Coverage 4.1%

- iShares MSCI Germany ETF (EWG): Germany Index. Return 1.8% Coverage 4.6% - personal portfolio - June

- OKLO: Nuclear Technology. Return 4.4% Coverage 9.2%

- Centrus Energy Corp. (LEU): Uranium Enrichment. Return 1.9% Coverage 10%

- Cameco Corporation (CCJ): Uranium. Return 1.1% Coverage 7.9%

- Robinhood Markets, Inc. (HOOD): Asset Management. Return 0.8% Coverage 9.9%

- Sprott Junior Uranium Miners ETF (URNJ): Uranium. Return 3.2% Coverage 0.9%

Kicked the can down the road on a few sold puts to reduce exercise risk - stock happy to hold later on.

- iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 64% profit on buy back. 43% cash positive - down in strike

- iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. 60% profit on buy back. 95% cash positive - down in strike

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 40% profit on buy back. 21% cash positive

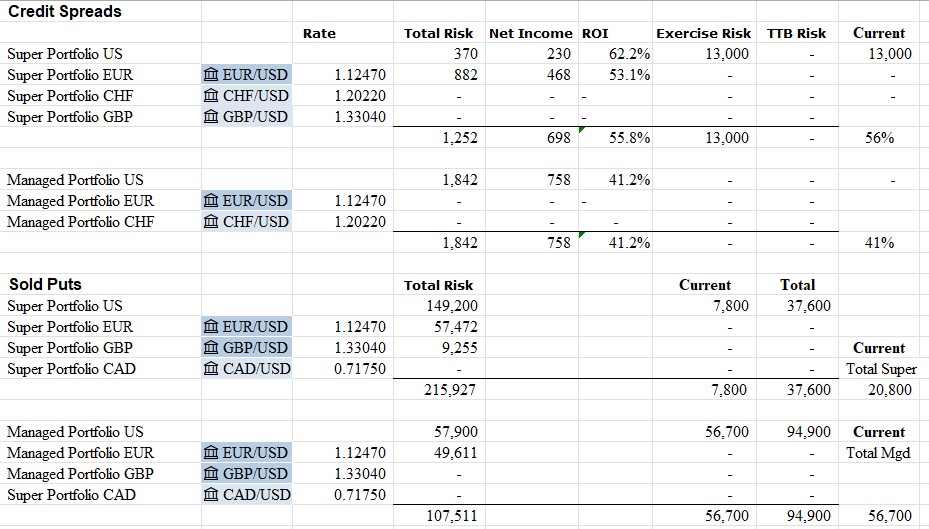

Credit Spreads

VanEck Junior Gold Miners ETF (GDXJ): Gold Mining. With price closing at $64.33, 65/62 credit spread has traded away from TTB to in-the-money. Will not be surprised to see this close above $65 by expiry.

The thought I shared on charts last week about price moving away from the oversold Stochastic RSI zone (lower panel - new green arrow) played out - a short run to go to pass the sold put strike (65)

Exercise risk on sold puts is under control for this expiry. The way the covered calls are running there will be plenty cash available for the next expiry.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 5-9, 2025

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

#hive #posh