What’s the profit potential if the market travels another 200 pips after buying the third block of 40,000 units?

A massive 24% profit.

How’s that possible, you ask?

Let’s crunch some numbers to find out.

The Mechanics Behind Pyramid Trading

Now that you have a good understanding of the dynamics behind pyramiding, let’s dig a little deeper and find out why it’s such a profitable strategy.

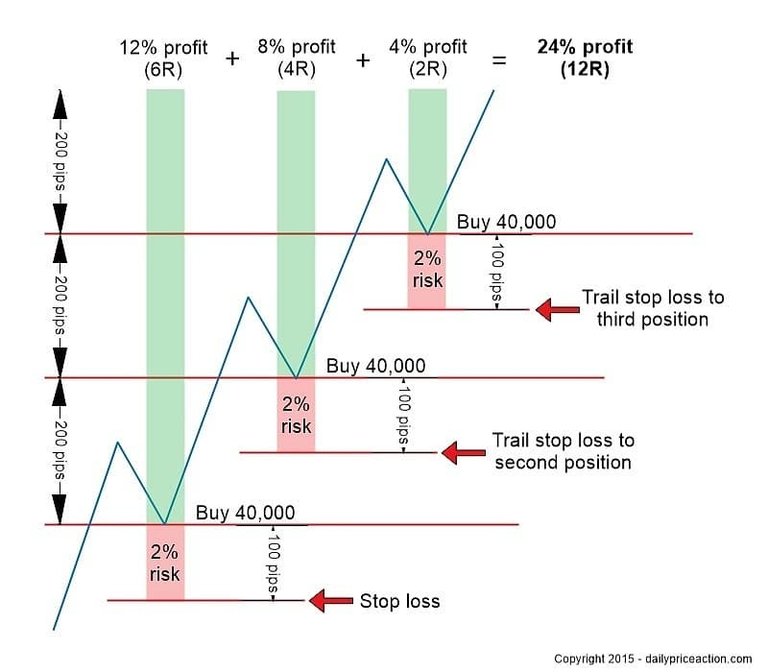

The illustration below shows the previous example, only this time we’re including the profit potential along with the risk profile of each entry.

This is where the real magic happens. Notice how the profit potential for each additional position is compounded throughout the trade, while the risk is continually mitigated.

The initial entry would have resulted in a 12% profit, which is considerable on its own.

However, by pyramiding, we were able to double the profit on the same trade while reducing our overall exposure.

Let’s take a look at the best and worst-case scenarios for each step of this trade.

First block of 40,000 units

Worst case: 2% loss

Best case: 12% profit

Second block of 40,000 units

Worst case scenario: Break-even (+2% from the first block and -2% from the second)

Best case scenario: 20% profit (+12% from the first block and +8% from the second)

Third and final block of 40,000 units

Worst case scenario: 6% profit (+6% from the first block, +2% from the second and -2% from the third)

Best case scenario: 24% profit (+12% from the first block, +8% from the second and +4% from the third)

As you can see from the figures above, the worst case scenario at any point in the trade is a 2% loss, while the best case scenario is a 24% profit. This makes pyramid trading not only extremely profitable but vastly more favorable compared to most other trading strategies out there.

Conclusion

Pyramid trading can be an extremely advantageous way to compound your profits on a winning trade. However, it isn’t without caveats and it shouldn’t be used excessively. If you find yourself trying to scale into more than one trade per month, there’s a good chance that you aren’t being selective enough about which trades to scale into.

Knowing when to use pyramiding takes a great deal of practice, just as the proper execution takes no small amount of planning. But the potential profit is well worth the time and effort

Last but not least, don’t get greedy. It’s far too easy to fall into the trap of thinking that the market isn’t going to reverse on you.

Remember, markets ebb and flow. Even the strongest trends experience pullbacks to the mean.

Have an exit plan outlined before entering the first trade in a series.

This allows you to define your plan while in a neutral state of mind. If you wait until you’re in a trade before defining an exit plan, there’s a good chance your emotions will get the best of you.

Here are a few things to keep in mind when using the pyramid trading strategy.

Only use the pyramid strategy in a strong, trending market

Always define your support and resistance levels before entering the trade (plan your trade and trade your plan)

Know your exit plan of where you want to book profits before entering the first trade

Maintain a proper risk to reward ratio at all times

Trail your stop loss behind each new position in order to mitigate your exposure

Keep things simple by using the same position size for each block of buying or selling

Don’t get greedy – stick to your plan no matter what.

Above all else, just remember to use pyramiding sparingly. This isn’t a technique you want to use on every trade or even every other trade.

But if you can catch just three or four pyramided trades per year, you’re looking at a profit potential of 60% to 80% from a mere handful of trades. Combine that with the fact that you’re only risking 2% each time, and you have a strategy that is as favorable as it is profitable.

Your Turn

Do you currently scale into winning trades using something similar to the pyramid strategy covered in this lesson? If not, do you think pyramiding is something you will use for future trades?

Leave your answer in the comments section below.