It is usually hard to tell when people are making more money in crypto. Only when they lose their money do they come out to rant about it. A lot of false news and exaggeration of figures exist out there; manipulation and confusion are created around the market just to make people fall into traps.

If none of these happen, everyone would be making a profit, but we can't all win. It is when one loses that it becomes a gain for another. If you can't win, you can learn to play safe.

Is it really difficult to play safe? While looking at how other people gamble with funds, sometimes we feel tempted to make a move as well. They call it risk-taking. At that junction, we are ready to dare what other people do and ready to bear the consequences if it results in loss.

Just this morning I was learning about how James Wynn went from $87M PnL to $8M in just three days trading futures. What sort of gambling with so much money can this be? He went long on BTC, incurred some amount of loss, came back to short it one more time only to incur some more losses before repeating the long process again. I really don't seem to understand why someone will risk so much. If I were to have so much money, would I be obsessed with trading (or gambling, because this has gone beyond trading) to risk so much while placing such high leverages?

Future trading is something I have hoped to try, but before that, one has to learn about how to predict the market, some fundamental analysis, and technical analysis. Market predictions are based on several kinds of this knowledge. You can't just go shorting coins anyhow without this knowledge unless you are prepared to lose it all. Seeing all these possible losses made me scared to even give this a try, not even when I'm certain of profit.

We now have communities that give signals to their subscribers who pay certain fees to subscribe for daily trading signals. Crypto is really unpredictable, and even the ones you are trusting to give you signals aren't always so sure; they can also go wrong even after all the analytical knowledge. For everyone new to trading, you're welcome to the gamblers' table with the potential for massive losses or otherwise. I have heard of risk management strategies where you place your risk at certain levels in order not to lose so much. It all works for experts with years of experience, even though they also do not always get it right. Hence, whenever you feel like joining the league of gamblers, be sure to have enough knowledge at hand.

Personally, this huge amount of losses totally puts me off, and I don't see myself trading future except for acquiring the knowledge of it so as not to remain ignorant of the many.

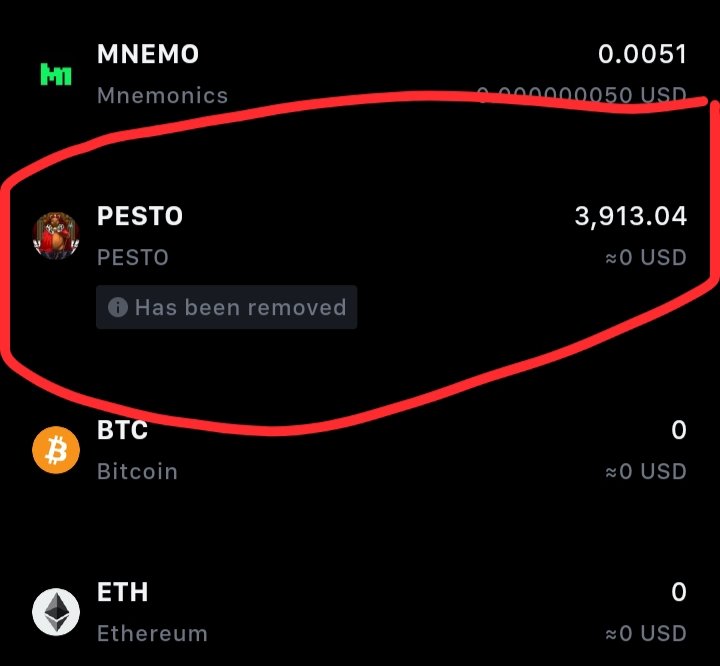

Where else can one lose finances in crypto aside from trading futures? There is even greater potential for losses if we invest in the wrong project. As much as it is advised that we should do quality research about tokens before investing in a token, is it possible to know it all? Don't purchase a token due to hype and promotion from influencers. It's a common warning, but I didn't give heed. That was how I purchased this particular token here that went from $10 to $0 before it was finally delisted.

I didn't practice any risk management to cut down losses and get back some of my money but kept nursing the feeling that, just like every other altcoin, this will come back to life again. The mail of it being delisted gave me the final conviction that the token has gone down the drain for life.

What token you can buy, hold, or trade is an important topic in the crypto space. I may not be able to pen down the exact count of the amount I have lost so far, maybe not yet, but it is obvious that you can be in the crypto space and not have an experience of loss

- Image one Canva designed.

Posted Using INLEO

Crypto truly is the wild west of finance where fortunes can vanish faster than a meme coin's hype! Your post perfectly captures that fine line between calculated trading and straight-up gambling.

You're absolutely right about needing proper knowledge before jumping into futures trading - it's like trying to perform brain surgery after watching one YouTube tutorial! Those signal groups often feel more like fortune tellers than analysts, don't they?

Your token delisting story hits hard - we've all been that hopeful investor watching our "sure thing" slowly sink to zero. Maybe the real crypto skill is knowing when to walk away from the digital roulette table.

At least now you've gained something more valuable than money - wisdom (though I'm sure you'd prefer the cash back)! Your experience will definitely help others avoid similar pitfalls.

You got me laughing.

Nobody can dare a surgery after watching YouTube video except , that's a perfect line well applicable to our trading experience.

I wouldn't have learnt a better way if there were no loses involved. Thank you for these lines they are valuable.