Yesterday, we had one of the most pivotal economic announcements of the month: Retail sales for May.

And I say pivotal because consumer spending is the No. 1 driving force of the U.S. economy. So, when we see a decline there, it naturally raises some concerns…

Because the issue isn’t just the numbers themselves. It’s the psychology behind them.

What is the consumer saying?

How are they feeling?

Where are they choosing to spend their money?

And if they’re starting to “tighten their belt,” that certainly says something about the direction of the economy as a whole.

THE NEW DATA

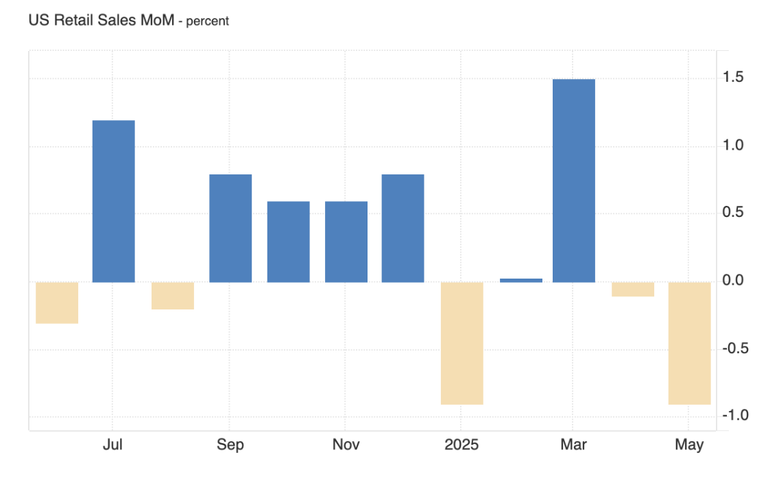

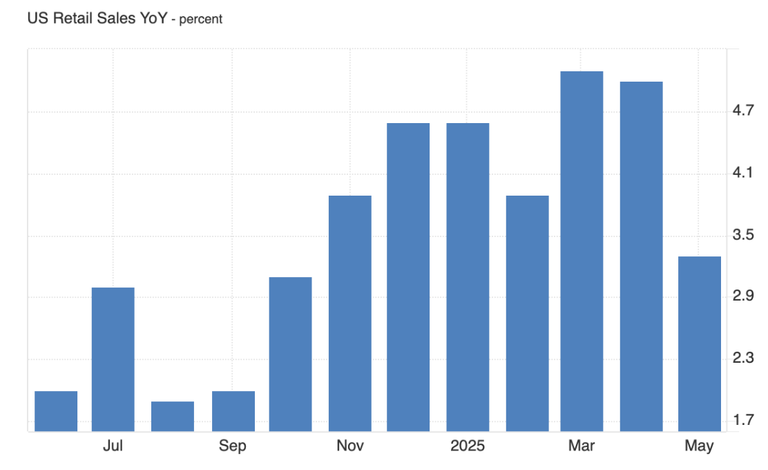

According to the latest official figures, total U.S. retail sales fell by 0.9% in May, significantly worse than the already negative forecast of -0.5%.

This drop follows April’s slight correction, which was also revised downward (from +0.1% to -0.1%).

On a year-over-year basis, sales rose by just 3.3%, compared to 5% in April—in other words, a slowdown.

Which categories were hit the hardest?

Well, the automotive sector saw a drop of -3.5%.

It seems Americans bought cars in March ahead of tariffs and avoided purchases in May—indicating a pattern of anticipation followed by a payback phase.

Gas stations saw a -2% decline, while building and garden materials were down -2.7%.

Restaurants saw a -0.9% drop, signaling that even entertainment and leisure are being scaled back. And that might be the most worrying sign of all—because people are usually reluctant to cut back on fun.

Even excluding autos, sales fell 0.3%, while the most important subcategory—the so-called “control group” (which feeds into GDP calculations)—rose only 0.4%.

So overall, we’re looking at a mixed result with a negative tilt.

Of course, these numbers may be masking deeper uncertainty in the background.

But not everything was in the red. Online sales, health and personal care stores, and various other retail categories saw increases.

WHAT DOES IT ALL MEAN?

The above tells us that:

(a) People are holding back and reducing their purchases,

(b) Tariffs and geopolitical tensions are affecting consumer sentiment and behavior, and

(c) Higher interest rates are now clearly having an impact on consumers.

Today, we also have the FED meeting on interest rate policy.

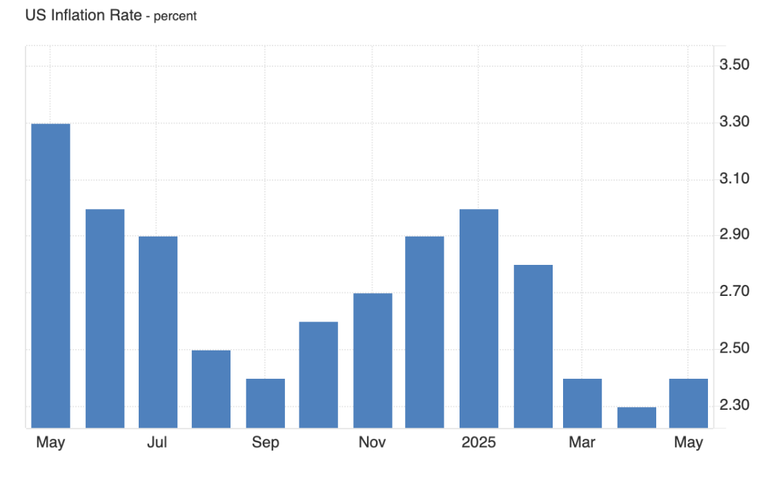

The retail sales data, combined with May’s soft inflation numbers, add further support for a pause in rate hikes—or at least a more dovish stance.

Because it looks like the economy is starting to slow down. And the last thing it needs now is more pressure from costlier borrowing.

So, what the FED chooses to do today will play a crucial role in the weeks ahead.

And as if that weren’t enough, we still have to see how recent developments in the Middle East might impact the June figures.

Will we see another drop in consumption? Will investment slow down further?

One thing’s for sure: Volatility remains high. And surprises are lurking.

The next set of data will give us our first glimpse of what’s coming.

Posted Using INLEO

This post has been shared on Reddit by @blkchn through the HivePosh initiative.

This is bad news. HIVE is currently at 20 cents, I dread to think how much it will fall if there is a deep correction in the markets.

At this time assets like hive are not in a good position because they are very risky . But at this point it is holding maybe we might visit 0.17

I saw this as a great opportunity - bought in

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.