KEY FACTS: Cardone Capital has launched the 10X Miami River Bitcoin Fund, combining a 346-unit multifamily property along the Miami River with a $15 million Bitcoin investment. This hybrid fund, inspired by a conversation between founder Grant Cardone and his brother, aims to convert monthly cash flows from the debt-free property into Bitcoin, leveraging the cryptocurrency’s growth potential alongside real estate’s stability. Targeting $1 billion in real estate and $200 million in Bitcoin across its hybrid funds, Cardone Capital is pioneering a novel investment model, with plans for a Bitcoin-backed mortgage product.

Source: Cardone Capital

Cardone Capital Unveils 10X Miami River Bitcoin Fund

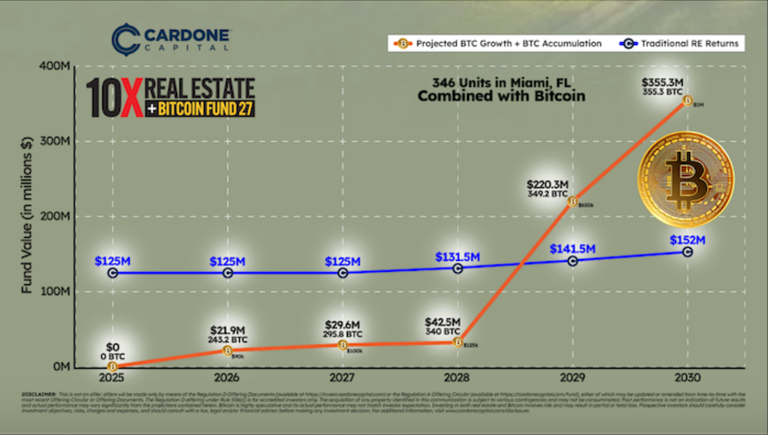

Cardone Capital, a leading real estate investment firm managing over $5 billion in assets, has launched the 10X Miami River Bitcoin Fund. Announced on May 25, 2025, this innovative dual-asset fund combines a prime 346-unit multifamily commercial property along the scenic Miami River with a $15 million investment in Bitcoin (BTC), marking a significant step in the firm’s strategy to integrate digital assets with tangible real estate investments.

The 10X Miami River Bitcoin Fund is Cardone Capital’s fourth foray into hybrid investment vehicles that blend the stability of cash-flowing real estate with the high-growth potential of Bitcoin. According to Grant Cardone, the firm’s founder and CEO, the fund will convert a portion of its monthly cash flows into Bitcoin, capitalizing on the cryptocurrency’s long-term appreciation potential while leveraging the steady returns of multifamily properties. This approach shows Cardone’s vision of creating investment opportunities that appeal to both traditional real estate investors and those intrigued by the transformative potential of digital currencies.

In an interview, Cardone revealed that a conversation with his sibling sparked the idea. Cardone recounted his brother saying:

“If you had converted all your cash flow from real estate to Bitcoin over the last 12 years, it could have turned $160 million into around $3 billion,”

This revelation prompted Cardone to explore ways to integrate Bitcoin into his real estate portfolio, which has resulted in the creation of the 10X Miami River Bitcoin Fund.

Cardone’s confidence in Bitcoin is bolstered by its recent performance and growing institutional acceptance. With Bitcoin trading above $100,000 in May 2025, Cardone sees it as an increasingly viable asset for wealth preservation and growth. He predicts Bitcoin could reach $250,000 in 2025 and climb to $1 million by 2030, driven by a crypto-friendly regulatory environment under the current U.S. administration and endorsements from figures like Commerce Secretary Howard Lutnick.

The 10X Miami River Bitcoin Fund is structured to appeal to a diverse investor base. The fund’s real estate component consists of a 346-unit multifamily property, strategically located along the Miami River, a vibrant and rapidly developing area in Miami, Florida. This Class A property is expected to generate consistent cash flow, with monthly distributions estimated at $350,000, free of debt. A portion of these cash flows will be systematically reinvested into Bitcoin, which Cardone plans to purchase within 72 hours of each distribution, using an institutional custodian to ensure security and compliance.

Source: Cardone Capital

This hybrid model draws inspiration from MicroStrategy’s Bitcoin acquisition strategy, pioneered by co-founder Michael Saylor, who suggested the approach to Cardone. The combination of real estate’s stability with Bitcoin’s growth potential is to mitigate the volatility associated with cryptocurrency while offering investors exposure to its upside. Cardone emphasized that this strategy is unique, stating, “Nobody’s ever done this particular model,” and noted the enthusiastic response from investors, including a long-time acquaintance who invested $15 million after years of skepticism about both real estate and Bitcoin.

Cardone Capital’s ambitions for its hybrid funds are bold. The firm aims to accumulate $1 billion in real estate assets and $200 million in Bitcoin as a treasury asset across its portfolio of hybrid funds. The 10X Miami River Bitcoin Fund is a critical step toward this goal, building on the success of Cardone’s earlier ventures, such as the $87.5 million 10X Space Coast Bitcoin Fund launched in December 2024. That fund, which paired a 300-unit multifamily property in Melbourne, Florida, with Bitcoin purchases, demonstrated the viability of the model, attracting significant investor interest.

Beyond the 10X Miami River Bitcoin Fund, Cardone is exploring new financial products to further integrate cryptocurrency into real estate. He is collaborating with other financial firms to develop a hybrid Bitcoin mortgage product. This innovative offering would allow clients to borrow against their combined Bitcoin holdings and real estate equity, potentially revolutionizing how investors leverage digital assets. Such a product could attract both crypto enthusiasts and traditional investors seeking flexible financing options.

This development adds to growing market trends, as financial institutions increasingly embrace tokenization and digital assets. For instance, Citigroup and Switzerland’s SDX are set to launch a tokenization platform for pre-IPO shares by Q3 2025, while BlackRock has filed to create a blockchain-based share class for its $150 billion Treasury Trust Fund. These developments underscore the growing acceptance of digital assets in mainstream finance, a trend Cardone is keen to capitalize on.

Cardone Capital’s latest venture builds on its strong track record in real estate. With a portfolio of 44 premium multifamily and office properties and over $1.4 billion raised from more than 13,800 investors, the firm has established itself as a leader in crowdfunding and real estate investment. In 2024 alone, Cardone Capital completed over $500 million in all-cash multifamily acquisitions, growing its portfolio to more than 14,000 units. The 10X Miami River Bitcoin Fund extends this momentum, offering investors a chance to participate in a novel asset class that combines the reliability of real estate with the dynamic growth of cryptocurrency.

Cardone’s journey with Bitcoin adds a layer of credibility to the fund. In 2013, he received 100 Bitcoins for a speaking engagement in Las Vegas, then valued at $500. By holding onto the asset, Cardone watched its value soar to $10 million, reinforcing his belief in Bitcoin’s long-term potential.

The 10X Miami River Bitcoin Fund is poised to attract a diverse investor base, including traditional real estate investors seeking exposure to cryptocurrency without directly navigating the complexities of decentralized finance (DeFi). Analysts like Ronen Cojocaru, CEO of 8081.io, view such funds as a sign of Bitcoin’s evolution from a speculative asset to a practical financial tool. The Miami River’s strategic location, coupled with Miami’s emergence as a crypto hub, further enhances the fund’s appeal.

The fund’s launch also underscores the growing prosperity of Miami’s real estate market. As one local expert noted, “Big money follows big opportunities,” and Cardone’s investment signals confidence in the region’s economic potential. The Miami River area, with its blend of urban development and waterfront appeal, is increasingly attracting high-profile investors, positioning it as a focal point for innovative financial strategies.

As Cardone Capital continues to push the boundaries of real estate and cryptocurrency integration, the 10X Miami River Bitcoin Fund represents a bold bet on the future of finance. Combining the stability of multifamily properties with the explosive growth potential of Bitcoin will help Cardone to diversify his firm’s portfolio and also redefine how investors approach wealth creation. With plans to expand its hybrid funds and develop new financial products, Cardone Capital is at the forefront of a financial revolution, one that could reshape the intersection of real estate and digital assets for years to come.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

Cardone with his 10X formula .....man is a die-hard fan of the 10X multiplier effect on everything ....