Last year I ran an investment analysis for a bunch of rental properties around WA state. The best market in terms of price to rent ratio was Olympia (state capitol).

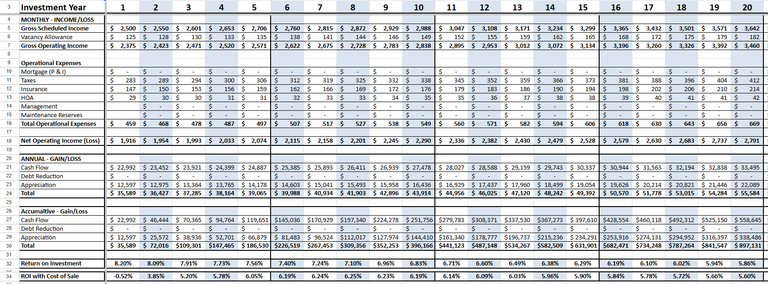

This had the best rent to price ratio of all properties for sale in the state Rent to Price Ratio: 0.595%

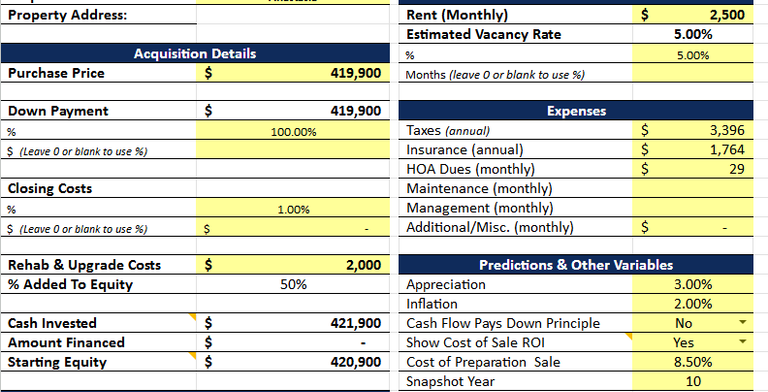

Here are the assumptions:

As you can see it was full cash investment as rates were around 7% for investment properties at that time so made zero sense to get a loan as it would not cashflow at all.

Still even though this had way better rent to price ratio than most properties in Washington state it still made no sense and the investor chose to go with another fixed income investment instead.

Yeah, the problem is, if you want to invest $420K in cash, NVDA would have been a better investment at that time frame :)

The allure is real estate, at least from my point of view, is the leverage and ability of have little cash in the deal. If you put 100% cash, and especially that magnitude of cash, there are so many other things you can do with it,